Since the Law “On Accounting” obliges all legal entities to reflect each business transaction through a primary document.

Such a document is also provided for the procedure for moving inventory from the supplier to the buyer.

It is a consignment note. Next, we’ll talk about the rules for filling it out and maintaining it.

Purpose of the document

As with other primary documents, it is provided regulated form to fill out- this is form 1-T, established by Decree of the State Statistics Committee of the Russian Federation No. 78 of November 28, 1997.

This document is completed immediately when transporting goods from the buyer to the supplier. several useful features:

- As a primary document it confirms the fact of movement of inventory items.

- On its basis, the seller has the right to write off and the buyer to capitalize the transported goods.

- It serves to calculate the driver’s salary as a document that takes into account the amount of work performed.

- Its presence makes it possible to confirm the right to a tax deduction for.

- Confirms the costs of transporting goods, which makes it possible to reduce the tax base for.

- TTN makes it possible to simply identify the purchased product.

Thus, the use of a consignment note is necessary in all cases of transportation of material assets from one legal entity to another.

Innovations in document maintenance rules

Separately, it is necessary to mention the changes dated December 3, 2015, introduced into Decree of the Government of the Russian Federation No. 272 dated April 15, 2011, which cause many discrepancies when applied in practice, since they introduce changes to the form of the consignment note.

But here it is necessary to pay attention that changes are made specifically to the waybill, and not to the 1-T TTN form. At the same time, the specified invoice, unlike 1-T, is not a primary document, since it does not have fields to reflect receipts and write-offs, and there is also no commodity part. And the legislative regulation of accounting obliges, when transporting goods, to reflect this fact without fail and precisely in the primary documents. Thus, the new form in no way replaces 1-T, but serves as an addition to it.

About document flow during cargo transportation, including the need to fill out the Transport and Bill of Lading, see the following video tutorial:

If you have not yet registered an organization, then easiest way This can be done using online services that will help you generate all the necessary documents for free: If you already have an organization and you are thinking about how to simplify and automate accounting and reporting, then the following online services will come to the rescue and will completely replace an accountant at your enterprise and will save a lot of money and time. All reporting is generated automatically, signed electronically and sent automatically online. It is ideal for individual entrepreneurs or LLCs on the simplified tax system, UTII, PSN, TS, OSNO.

Everything happens in a few clicks, without queues and stress. Try it and you will be surprised how easy it has become!

Procedure for compilation

Discharged The TTN is filled out jointly by the shipper and the carrier. The form is issued in four copies, each of which is an original.

Discharged The TTN is filled out jointly by the shipper and the carrier. The form is issued in four copies, each of which is an original.

Provider enters the document number and date of transportation, details of the parties and information about the goods in all copies. He certifies everything with the necessary signatures and seals, after which he keeps one of them and transfers the other three to the carrier. He brings all three copies recipient together with the cargo, after unloading and accounting for the delivered goods, the head of the recipient organization and the financially responsible person put their signatures on the receipt and certify with the seal of the organization, after which one of the remaining three copies is kept for themselves, the remaining two are returned to the carrier.

Transport company Based on the fully completed TTN, he draws up a work completion certificate, attaches it to one of his two copies along with the invoice for payment and forwards it to the party to the transaction who will pay for the transportation. The last copy remaining with the carrier is attached and, on the basis of these documents, a driver is produced. They are stored in the transport company’s records.

In cases where a vehicle transports several consignments of goods for different consignees in one trip, a TTN is issued for each of them and for each consignee.

When, during unloading of valuables, a discrepancy between the quality or quantity of the goods indicated in the invoice is revealed, a report is drawn up regarding the discrepancy, and a note is made on the invoice form.

Filling rules

Form 1-T consists of two parts - commodity and transport. Accordingly, the goods part is filled out by the supplier and the transport part by the carrier.

By the time the freight transport arrives, the shipper must include in the consignment note following information:

- Date of preparation;

- Document Number;

- Details of the parties to the transaction;

- Addresses for loading and unloading of goods;

- Information about the cargo being transported: codes, nomenclature, name, units of measurement, quantity, price, etc.

- Officials who gave permission for shipment (usually the manager and chief accountant).

After the vehicle arrives, the invoice includes carrier information:

- Waybill number;

- Name of the transport company;

- Car make;

- Her state number;

- Last name and initials of the driver;

In addition, you must enter information about the type of packaging of the goods. If it is not packaged, “unused” is entered in this field. If the packaging of the cargo involves sealing or sealing, a sample of the seal impression must be included in the document so that the recipient has the opportunity to compare the match.

You must also enter in the designated fields such characteristics, such as the type of loading and unloading, net and gross weight, the number of places occupied by goods in the vehicle. If the product cannot be recalculated by the number of pieces because it is bulk, this fact must also be reflected.

After weighing the cargo, you must indicate the method for determining its weight and the type of scales that were used.

In cases where it is necessary to send along with the goods any accompanying documentation, the driver is obliged to accept it and deliver it to the recipient along with the cargo. A note is also made on the delivery of such documents in the TTN with a listing of the attached documents.

Design nuances

Often as applications an invoice may appear in the form. This is required in cases where the product part of the specification document does not fully reflect all information about the product and a more expanded version of the document is required. However, since TORG-12 contains exclusively the commodity part and does not reflect the fact of movement of valuables, in cases of their transportation it cannot act as an independent document, but is only an additional annex, which the parties may or may not draw up if all the necessary information is already contained in TTN.

The exception is the method of transportation by pickup when a third party in the form of a transport company is not involved to implement the terms of the transaction. Then the recipient himself acts as the carrier and the parties only need to confirm the fact of shipment and receipt. In this case, a consignment note in the TORG-12 form will be sufficient to confirm this business transaction.

The exception is the method of transportation by pickup when a third party in the form of a transport company is not involved to implement the terms of the transaction. Then the recipient himself acts as the carrier and the parties only need to confirm the fact of shipment and receipt. In this case, a consignment note in the TORG-12 form will be sufficient to confirm this business transaction.

It should be borne in mind that in addition to Form 1-T, which is valid for standard cargo transportation, there are also special cases in which certain categories of cargo are provided special forms.

For example, if transportation is carried out to the territory of another state, the invoice is drawn up in form 1-TM.

For transporting products that contain alcohol content, you will need to issue a special certificate to 1-T, as provided for in the clarification of Rosalkogolregulirovanie dated 07/08/2011.

Grain products, which is delivered to grain collection points, elevators and other destinations, must be accompanied by an invoice in the form SP-31.

Transportation of animals must be completed by the head of the livestock farm with the obligatory participation of a veterinarian in the form SP-32.

Transportation of animals must be completed by the head of the livestock farm with the obligatory participation of a veterinarian in the form SP-32.

Since delivery milk and dairy products to factories and stores from manufacturers should be carried out only with mandatory verification of product characteristics, such as fat content, acidity, etc., all these procedures are carried out before shipment and the results are recorded in the consignment note in the SP-33 form.

A separate form of form No. SP-34 is also provided for shipment agricultural products, such as fruits, vegetables, berries, etc.

Poultry products in the form of eggs must be accompanied by an act of sorting them in the workshop according to the SP-26 form, attached to the invoice.

Wool, as a specific type of product, during transportation is also described in a special form SP-35, which contains all the necessary fields to indicate the individual characteristics of this type of product. Such an invoice implies the fields contained on the back of the form.

Many companies interact with each other at a distance, periodically transferring to each other various inventory items that are delivered by transport. In this case, the cargo must be properly registered. A waybill (Bill of Lading) is an accompanying and acceptance document, and it will always need to be drawn up when delivering goods by transport. This document is required for a complete set when issuing an invoice as confirmation of receipt of the goods. It must also be used to confirm transportation expenses and write off gasoline for income taxes.

A TTN must be drawn up if the transportation of material assets is carried out by the sender or a third party. The TTN is issued by the company that organizes the delivery.

This document confirms the sending and receipt of goods, as well as the fact of transportation itself. Form 1-T is especially important when delivery is carried out by third parties. It is according to the TTN that carriers accept, check and transfer goods to consignees. It allows you to go to court in case of loss or damage to cargo.

If transportation is carried out by several transport companies, the consignor draws up separate consignment notes for each consignee.

Very often, one vehicle transports cargo intended for several consignees. In this case, invoices must be issued for each consignee.

The document does not need to be drawn up if the goods are transported by the recipient. In this case, the receiving organization records all data about it on the vehicle’s waybill.

The tax office requires the provision of a TTN from VAT payer organizations to confirm the deduction of input VAT as primary documents for the receipt of material assets.

According to PBU, costs for the delivery of material assets are included in their cost. To prove the economic feasibility of costs and the correctness of determining the cost of inventory items, the tax service first of all requires a TTN.

This invoice consists of two parts: commodity and transport.

The first part of the document regulates the relationship between the shipper and the consignee, the second part between the customer and the carrier. Since 2011, along with the 1-T form, a consignment note began to operate, which does not have a commodity section. It is also required to be filled out.

The TTN is drawn up by the seller in four copies. In the first, the driver of the shipper or carrier signs for acceptance of the goods, it remains with the seller. The second and third, after signing by the consignee, are taken by the transport company to issue invoices for transportation and pay the driver a salary. The fourth copy is with the receiving party upon receipt of the goods.

For the transportation of goods for which warehouse accounting is not organized (for example, in quarries - gravel, sand, crushed stone), this consignment note is drawn up in triplicate.

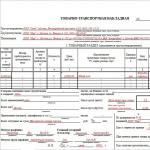

Consignment note sample filling

Organizations use the standard intersectoral form N 1-T.

Let's look at how to fill out the TTN for the shipper.

In the appropriate lines, the accountant of the sending organization writes down the serial number and date of the document. After this, you must fill in the names, codes, addresses, telephone numbers of the shipper, consignee and payer. For the latter, bank details are also indicated.

In the tabular part of the product section, information about the transported material assets is filled in: analytical accounting code (item number), article number, quantity, price per 1 unit, name of goods and materials, unit of measurement, type of packaging, number of pieces, weight and total cost. If the TTN is drawn up on several sheets, this must be reflected in the corresponding line in words as well as information on the number of items of the product, the space occupied, its net and gross weight. It is also necessary to enter data (if any) on other accompanying documents (certificates, passports, etc.). Below is the total cost of the transported goods.

Let's consider the rules for filling out the TTN regarding the transport section.

It must contain information about the delivery time, information about the TTN numbers and the waybill of the vehicle on which transportation is carried out. Next, enter the name, address, telephone number, bank details of the carrier organization, registration data for the vehicle, and information about the driver. If there are trailers, their information must also be reflected in the TTN.

Information about loading and unloading points is filled in the corresponding line.

The tabular part displays information about the cargo (name, accompanying documents, number of pieces and weight).

Below, the transfer records of the person who released the goods (shipper) and the person who accepted the goods (consignee) are filled out, and the corresponding stamps are affixed.

The driver must fill out information about loading and unloading operations (who carried them out, how and when).

At the bottom of the document there are columns that indicate all the necessary information and calculation of wages, if the driver is paid according to the piecework payment system.

Sample of filling out the form can be viewed below.

Nuances of filling out some waybills

The supply agreement may provide that the seller carries out loading and transportation of the cargo, and the buyer compensates him for the costs. Then in the technical document in the product section you need to fill in the column “Warehouse or transportation costs”.

The cargo can be transported by a transport company. The shipper's warehouseman must fill out the data from the corresponding power of attorney in the goods section in the lower right corner, and the transport section will be completed by the carrier.

Several trucking companies can be used to transport inventory items. In this case, the shipper needs to write out a TTN for each of them, and when filling out the transport section of the document, enter information about the redirection and the new consignee.

In accordance with the agreement, delivery can be ordered by the buyer of the goods. He finds a transport company and enters into an agreement with it. According to the rules, the buyer, who will be both the consignor (he organizes the transportation) and the consignee, must fill out the consignment note in this case.

After an audit, any auditor will say that the absence of a consignment note (Bill of Lading) entails unpleasant tax consequences for the organization. And he will be right, because, in accordance with paragraph 1 of Article 9 of the Law of November 21, 1996 No. 129-FZ “On Accounting” (hereinafter referred to as Law No. 129-FZ), all business transactions carried out by the organization must be documented documents. They serve as primary accounting documents on the basis of which accounting is conducted. Let's consider this issue in more detail.

When to draw up a TTN

TTN (for a sample of filling, see Example 1) is an accompanying document when transporting goods by road (clause 2.1.2 of the Methodological recommendations for accounting and registration of operations for receiving, storing and releasing goods in trade organizations (approved by a letter from Roskomtorg dated July 10, 1996 No. 1-794/32-5).

When transporting goods by road, acceptance of incoming materials is carried out on the basis of a consignment note received from the shipper (clause 49 of the Guidelines for accounting of inventories, approved by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n).

The need for the consignor to draw up a specification form is also confirmed by paragraph 47 of the “Charter of Motor Transport of the RSFSR”, approved by Resolution of the Council of Ministers of the RSFSR dated January 8, 1969 No. 12 (hereinafter referred to as the Charter). In accordance with this document, the shipper must submit to the motor transport enterprise or organization a consignment note for the cargo presented for transportation, which is the main transportation document and according to which this cargo is written off by the shipper and received by the consignee.

Transportation of goods by road in urban, suburban and intercity traffic is carried out only if there is a registered TTN (clause 2 of the instructions of the USSR Ministry of Finance No. 156, USSR State Bank No. 30, Central Administration of the USSR No. 354/7, Ministry of Autotransport of the RSFSR No. 10/998 dated November 30, 1983 "On the procedure for payment for the transportation of goods by road" (hereinafter referred to as Instruction No. 156)).

|

Larina S.N., lawyer, tax consultant Another argument in favor of drawing up a TTN can be considered clause 2.1.1 of the Traffic Rules, approved by Decree of the Government of the Russian Federation of October 23, 1993 No. 1090. According to this norm, the driver is obliged to carry with him and, at the request of police officers, hand over to them for inspection, including shipping documents. The absence of accompanying documents specified in paragraph 2.1.1 of the Traffic Rules is sufficient grounds for the seizure of transported inventory items. TTN is the only document used for writing off inventory from shippers and posting them to consignees, as well as for warehouse, operational and accounting (clause 6 of Instruction No. 156). The consignor must draw up a specification form for the transportation of goods by road for each vehicle trip for each consignee separately, with the obligatory completion of all details (clause 10 of Instruction No. 156). TTN must be necessarily attached to waybills (clause 17 of Instruction No. 156). However, there are exceptions here (clause 5 of Instruction No. 156). No TTN required:

Since waybills are drawn up by all organizations that have their own or leased vehicles, when releasing a vehicle onto the line (clause 15 of Instruction No. 156), a TTN should be drawn up if the cargo is delivered by the shipper. Thus, TTN compiled by the shipper in two cases:

In the event that the buyer (the consignee) removes the cargo independently , registration of a TTN is not required. |

TTN or TORG-12?

Larina S.N., lawyer, tax consultant answers the question

It is not clear from the question who delivers the goods: the supplier independently or with the participation of the carrier. Let's consider both options.

The organization delivers the goods by engaging a carrier.

The consignment note (form No. TORG-12) (for a sample filling, see Example No. 2), in accordance with the album of unified forms for recording trade operations, approved by Resolution of the State Statistics Committee of December 25, 1998 No. 132, is used to register the sale (issue) of goods -material assets of a third party organization. Thus, TORG-12 is the primary document certifying the transfer of ownership of the goods from the seller to the buyer.

As for the TTN, in accordance with paragraph 2 of Article 785 of the Civil Code, the conclusion of a contract for the carriage of goods is confirmed by the preparation and issuance of a consignment note to the sender of the goods. In addition, as noted above, the cargo transport document is a transportation document and on its basis the cargo is written off by the consignor and received by the consignee.

Thus, both TORG-12 and TTN confirm the completion of the same business transaction - the transfer of goods by the seller to the buyer. However, the fact of transportation of goods should be formalized specifically with a consignment note, and TORG-12 acts as an annex to the consignment note. The fact is that, in accordance with paragraph 6 of Article 9 of Law No. 129-FZ, in order to control and streamline the processing of data on business transactions, consolidated recorded documents are compiled on the basis of primary documents. Therefore, one of the documents will be primary, and the second - summary.

In our opinion, the transport invoice will be primary in the situation under consideration, since it confirms the fact of shipment and delivery of the goods to the buyer. So, on the first page of TORG-12 there is a section “Consignment note”, in which information about the consignment note is entered.

But keep in mind that you can’t do without TORG-12 in this situation either. Note that, unlike the trade invoice, the TTN does not have a column in which it is necessary to enter information about VAT in a separate line. But in accordance with paragraph 4 of Article 168 of the Tax Code, in settlement documents, primary accounting documents and invoices, VAT amounts must be highlighted on a separate line. It is on this formal basis that tax officials can refuse to deduct VAT.

As for the risks due to the absence of a specification form, they may arise from the buyer or the shipper. In the first case, due to failure to confirm the fact of transportation of the goods, in the second - due to the lack of shipping documents. In any case, even if you have a properly executed invoice and despite positive judicial practice, in order to avoid disputes with the tax authorities, we recommend that you also issue a TTN.

The supplier independently delivers the goods.

In this case, the primary accounting document will be the delivery note. The first copy of TORG-12 remains with the seller, who hands over the material assets and is the basis for their write-off. The second copy is given to the buyer, and based on it he receives the goods. The second copy is handed over by the seller's forwarder, who accompanies the transportation of the goods, at the time of delivery of the goods. Thus, formally, in the situation under consideration, drawing up TORG-12 is sufficient.

However, one should not forget about the requirement of paragraph 2.1.1 of the Traffic Rules, according to which the driver is obliged to have with him and, at the request of the police officers, hand over to them for verification, including shipping documents. But in their absence, the cargo may be seized.

TORG-12, as a primary accounting document, has a strictly defined purpose - registration of the sale of inventory items to a third party and is not an accompanying transport document. But the TTN acts not only as a primary document, on the basis of which the seller writes off inventory items and the recipient arrives, but also as an accompanying transportation document.

Therefore, in this situation, similar to the previous one, we recommend issuing both TTN and TORG-12.

Consequences of missing TTN or incorrectly drawn up TTN

In accordance with paragraph 2 of Article 9 of Law No. 129-FZ, primary accounting documents are accepted for accounting if they are drawn up in the form contained in the albums of unified forms of primary accounting documentation, and documents whose form is not provided for in these albums must contain mandatory details. The form of the consignment note (Form No. 1-T) was approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78 “On approval of unified forms of primary accounting documentation for recording the work of construction machines and mechanisms, work in road transport” (hereinafter referred to as Resolution No. 78).

Tax authorities often refuse to deduct VAT in the absence of a tax identification document. Courts often side with the taxpayer and indicate that in order to deduct VAT, it is enough to have a properly executed delivery note and invoice. Let's consider the opposite situations, when the absence or incorrect completion of the TTN leads to negative consequences for the organization.

Judicial and arbitration practice

Judicial and arbitration practice

Judicial and arbitration practice

Judicial and arbitration practice

Judicial and arbitration practice

Procedure for filling out the TTN

In accordance with Resolution No. 78, the TTN is issued in four copies. The first one remains with the shipper and is intended for writing off inventory items. The second, third and fourth copies, certified by the signatures and seals of the shipper and the signature of the driver, are handed to the driver.

The second one is handed over by the driver to the consignee and is intended for the receipt of inventory items from the consignee.

The third and fourth copies, certified by the signatures and seals of the consignee, are handed over to the organization that owns the vehicle.

The third copy, which serves as the basis for calculations, is attached by the transport organization to the invoice for transportation and sent to the payer - the customer of the vehicle, and the fourth is attached to the waybill and serves as the basis for accounting for transport work and calculating wages to the driver.

There are no more detailed instructions on filling out this form in the regulatory documents. Section 2 of Instruction No. 156 provided clarifications, but they relate to Form No. 1-T, which was Appendix No. 1 to this Instruction and was canceled by Resolution No. 78.

is a document that is used by enterprises that deliver products using vehicles. We will tell you how to correctly draw up this document and what information its sample should contain in this article.

The new consignment note is a document that is used by enterprises that deliver products using vehicles.

Standard form of TTN

A waybill (BW) is a document that confirms the movement of goods (products, items) from one place to another using vehicles.

The standard form of this document was approved by Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78.

The named form replaced the previous TTN form (a specialized form approved in the USSR).

TTN form 1-T consists of two parts:

- Commodity, which contains a list of transported products. It also serves as the basis for writing off products from the seller’s (supplier’s) warehouse and their receipt at the buyer’s warehouse.

- Transport, which determines the order of delivery of these products, as well as the relationship between the seller and the carrier. This section, among other things, will also confirm the provision of services for the transportation of goods.

In the current legislation, in addition to the TTN, there is also a separate form of the consignment note, adopted by Government Decree No. 272 of April 15, 2011.

The main difference between these documents is that the bill of lading completely lacks a section describing the products to be delivered. That is, information about the name of the product, quantity, and amount is not written down anywhere. It is only possible to indicate the type of goods.

- when transporting (delivering) products using their own vehicles, it is most convenient for enterprises to fill out the TTN form 1-T;

- When involving foreign organizations in delivery, it is permissible to use a bill of lading.

Rules for filling out TTN 1-T

TTN (Form 1-T) is issued separately for each flight performed for the delivery of goods. Accordingly, a separate document is drawn up for each buyer (consignee).

It should be noted that this document is very important when moving products, since it is one of the list of papers that must be presented to traffic police officers. Thus, the TTN form 1-T confirms the fact that the goods are not stolen, and in its absence, law enforcement officers have the right to seize the entire batch of transported products.

The specified paper is drawn up by the shipper in four copies:

- The first copy remains at the place of its registration, that is, with the seller (shipper), the next three are handed over to the driver of the vehicle for further movement.

- The driver must hand over one of the three copies to the representative of the buyer (consignee).

- The remaining two copies remain with the carrier organization, one of which serves as confirmation of the provision of delivery services and is sent along with the invoice to the customer, and the second serves as the basis for payment for the driver’s services and is filed along with the waybill.

However, in relation to non-commodity goods that are not subject to warehouse accounting, that is, those that are measured by measuring and weighing, it is necessary to draw up a cargo transport form in triplicate:

- Two copies are given to the owner of the transport, one of which serves as confirmation of the provision of delivery services and is sent along with the invoice to the customer company, and the second is the basis for calculating payment to the driver, as well as a means of accounting for transport work.

- The third copy is kept by the seller (shipper) to confirm and record the completed transportation.

TTN 1-T form - product section

Since 2013, unified forms of some documents are not mandatory for use, however, if the enterprise uses some forms as a basis, all fields of such forms must be filled out. A sample of filling out the TTN according to Form 1-T is presented below.

Sample of filling out the consignment note 1-T

The delivery note (commodity section) includes the following data:

- Full details of the shipper are recorded, including addresses, bank details, and contact numbers.

- It is necessary to indicate the name of the consignee's company, its address, telephone number, as well as bank details.

- The same data is registered in relation to the payer company.

- In the tabular part, the shipper (seller, supplier) fills in the product section, namely:

- product code, in accordance with the accepted nomenclature;

- price list number and, if any, an addition to it;

- article or price list number;

- quantity;

- price in rubles and kopecks;

- name of the product, cargo, indicating the brand, article, brand, grade, etc.;

- the unit of measurement in which the product is supplied;

- name of container, packaging;

- number of occupied seats;

- weight in tons;

- the total amount in rubles and kopecks, indicating the percentage of markup, transportation costs and the total amount to be paid;

- serial number according to the warehouse card file.

- Below, under the tabular part, you should write down the number of sheets that serve as a continuation of the invoice.

- The name of the goods (total quantity) should be indicated in numbers.

- The number of seats is indicated in words.

- The net and gross weight of the cargo is recorded both in words and in numbers.

- If there are certificates, their number is indicated in words.

- The column about the amount of goods sold must be filled out in words only.

- In the lower left corner, the driver’s power of attorney number is recorded, as well as his data, and the driver’s signature is affixed.

- After delivery of the goods, the following is signed (with a transcript) by the recipient's representative.

Procedure for completing the transport section

An example of the reverse side of a TTN consists of the following information:

- Delivery time of cargo.

- The organization responsible for it.

- Car make, with license plate number.

- Names of the customer for transportation, indicating the address, telephone number, bank details.

- Personal data of the driver including the driver's license number.

- Places for loading and unloading of products.

- Product details:

- product names;

- attached documentation;

- packaging indicating its types;

- number of places;

- method of calculating (measuring) mass;

- code, cargo class;

- total weight, gross.

- The number of places with gross weight is recorded below in words.

- The signatures of the following persons are added:

- the storekeeper who handed over the goods;

- the driver who accepted the products for transportation;

- the storekeeper who accepted the delivered goods.

- The tabular section below contains information regarding the loading and unloading operations performed, namely:

- name of the enterprises performing loading and unloading;

- indications of additional activities;

- loading method;

- time of arrival (departure) for loading (unloading).

- Next, information regarding the transportation distance must be filled out, indicating the necessary tariffs and calculations.

- The last thing to fill out is a calculation of the cost of services provided, indicating all possible additional payments and the total amount.

TTN (Form 1-T) is considered a reporting document. Based on it, it is possible to obtain information about the type of goods to be transported, its quantity, the make of the car, information about the driver and many other information necessary for making final settlements between the parties.

The main document accompanying the transported cargo is the consignment note (waybill), the form of which has been developed and approved in a single form. Learn how to fill out the document and the legal features of its validity right now.

In 2018, no changes to the form occurred - there is a specially developed, unified form of consignment note, called form 1-T. Along with it, the usual form of invoice also works. The difference between them is as follows:

- The main invoice - that is, a document in Form 1-T - is used in cases where goods and other material assets are transported by a third-party carrier.

- The consignment note form TTN (approved by Government Decree No. 272 in April 2011) is used when the buyer of the goods or its supplier transports the cargo using its own fleet of vehicles.

From a legal point of view, the documents are equivalent. The Federal Tax Service clarified that to calculate income tax, you can use any form of consignment note.

Form 1-T

According to the developed and approved form, the document consists of two sections (each takes 1 printed page):

- First page (the so-called product section)

The “header” of the document indicates the full names of companies (or individuals) – the sender and recipient of the goods. At the same time, there are no specific explanations in the legislation on the design of this clause - i.e. any legal entity has the right to indicate its name in full or abbreviated form.

Next, all inventory items that are sent from point A to point B are listed. The net and gross weight is registered, the signature of the chief accountant and the persons who authorized and carried out the issuance of the cargo to the driver for its transportation are affixed.

- The second page (the so-called transport section) is the actual description of the cargo, what documents accompany its transportation, the type of packaging (for example, cardboard, pallet, film, etc.), the weight of the cargo. Information about loading and unloading operations is also indicated.

NOTE. It is most convenient to compose a document in Ms Excel than in Word, since in this case it is more convenient to export all data from different programs, as well as perform arithmetic operations immediately when composing.

TTN form (Government Decree No. 272)

This document has been used since 2011 and has a more simplified version compared to the 1-T form. Also consists of 2 pages:

Explanations for the document:

- Accompanying documents are those that are directly related to the cargo - they describe the quality of the goods and their compliance with accepted standards. These can be quality passports, certificates, etc.

- The shipper's instructions refer to the specifics of cargo transportation - for example, what temperature conditions should be observed, what maximum speed can this product be transported, what should be the minimum capacity of the vehicle in terms of weight and volume, and other essential conditions. They are prescribed by the shipper at his own discretion. If no special conditions are required, a corresponding note is placed.

- The date and time when the vehicle should be delivered for loading and unloading of the transported goods - here you need to indicate two values: one is written in accordance with the contract (as originally intended), the other - in fact (even if both values completely coincide).

- According to the conditions of transportation - in many cases, the clause is simply ignored and remains empty: if the conditions completely coincide with the usual ones (which are specified in the Road Transport Charter).

- According to information about the vehicle, you need to indicate the maximum carrying capacity (measured in tons) and maximum capacity (indicated in m3).

- In reservations and comments, the carrier optionally writes down his comments if the actual condition of the cargo does not correspond to the declared one.

- In the “Other conditions” section, entries are made only if we are talking about the transportation of special categories of cargo - dangerous, large, heavy. Such cargo necessarily requires additional permission to be transported.

- The “Forwarding” item is filled in only if the route along the route for some reason has changed compared to the original one.

- The “Cost of services” item indicates the final delivery price taking into account the actual route - this is filled in in any case, even if the cost has not changed compared to the originally planned one.

- Finally, the last paragraph “Marks” is filled out only in cases where the contract of carriage was violated for some reason. In these cases, a violation report must be drawn up, the cost of the fine is determined, the signatures of the responsible parties and the date of the violation are affixed.

Legal meaning of the document

Regardless of the specific form of the TTN, it performs several functions:

- It is the invoice that assures the parties that a transportation contract has been concluded and clarifies all the details of the process: what goods are being transported, in what time frame, by what transport, what is the cost of goods and the cost of cargo transportation services.

- Thanks to the invoice, the movement of goods is recorded - i.e. This is the basis document for deregistration of a certain amount of goods from the warehouse of the seller (supplier) and capitalization by the buyer (consignee).

- The TTN confirms the amount of goods transported, from which income tax is calculated.

- TTN is a legal confirmation of the legality of a cargo transportation operation: it is this document that the driver should always have with him in case he presents it to the traffic police inspector.

Number of document copies

As a rule, the TTN is drawn up in 4 copies, each of which is an original with full legal effect. The purpose of each copy of the bill of lading forms is described in the table.

| 1 | remains with the company that sent the goods; this is the main document on the basis of which all shipped goods in the specified quantity are written off |

| 2 | is transferred to the recipient of the cargo by the driver who delivered it; this is the main document on the basis of which goods are registered (posted) in the specified quantity |

| 3 | transferred to the carrier itself; this is the main document that confirms the completed service for transporting goods and serves as confirmation of the amount of this service (taking into account route correction, etc.) |

| 4 | also given to the carrier - it is attached to the driver’s voucher; based on this, the driver’s salary is calculated |

Commodity and consignment note

You should not confuse 2 different documents - the waybill (TN) and the waybill (TTN), the forms of which were discussed above (forms 1-T and TTN).

- The consignment note records the very fact of the purchase and sale of goods, so it is always issued if there is a fact of this transaction, regardless of whether the goods will be transported or not.

- The consignment note records only the fact of cargo transportation: what goods, in what quantity, what weight, under what conditions of transportation, etc. Those. this document reflects the transportation of goods, but does not contain anything regarding the purchase and sale transaction.

Thus, if the product is sold, and it is also expected to be delivered to another point, then both the TN and the TTN are issued. If the product is simply sold and the buyer picks it up himself, only a TN is issued.

Registration of TTN in 1C: step-by-step instructions

Invoices of both forms can be issued in the 1C program. To do this you need to do the following:

Detailed video instructions for creating a bill of lading form, as well as a bill of lading, can be seen here.