New form "Certificate of income of an individual" officially approved by the document Order of the Federal Tax Service of Russia dated January 17, 2018 N ММВ-7-11/19@.

More information about using the form “Certificate of Income of an Individual”:

- Changes in 2-NDFL and 6-NDFL

And personnel management 8.” 2-NDFL First, let's look at the changes, ... however, the abbreviated name of the certificate “2-NDFL” has been retained. Certificate 2-NDFL for transfer to the Federal Tax Service... does not have an abbreviated name). Certificate 2-NDFL, which is intended for tax authorities... the same. According to the rule, the 2-NDFL certificate must be submitted to the tax authority... the last day for submitting the 2-NDFL certificate will be the next next business day... and selecting “Income Certificate (2-NDFL)” the program will display a preview window...

- Reporting on form 2-NDFL in 2019

Amounts of tax of an individual" (form 2-NDFL), the procedure and format for its submission... the message must be submitted according to form 2-NDFL, approved by this order, no later than... -11/485@. When filling out form 2-NDFL (form according to KND 1151078), indicate... tax. In the “Sign” field of the 2-NDFL form the following number is entered: “1” – if the certificate... tax was withheld, the 2-NDFL certificate is filled out with the sign “2” in the usual...

- 2-NDFL: analyzing changes and complex issues

Changes in the 2-NDFL certificate for 2017. Deadline for submitting the 2-NDFL to the Federal Tax Service... In terms of income on the 2-NDFL certificate, new codes have been added: 2013 –... Frequently asked questions about filling out the 2-NDFL Example 1. When submitting ... in this case, is a 2-NDFL certificate issued for this employee? This species... Tajikistan. How to fill out a 2-NDFL certificate for this employee for 2017... of a separate division. How to fill out a 2-NDFL certificate for this employee? When filling... unit. Please note: another 2-personal income tax can be submitted no later than 1 ...

- How to submit 2-NDFL and 6-NDFL when changing legal address: a new approach of tax authorities

How to submit information on 2-NDFL and 6-NDFL when changing... how to submit information on 2-NDFL and 6-NDFL when changing... information every quarter, according to the 2-NDFL form - once a year. In both... it also applies to form 2-NDFL, the procedure for submitting information to tax authorities when... using forms 6-NDFL and 2-NDFL and at the “old” address of the tax...

- Features of filling out the 2-NDFL certificate. New income and deduction codes

Are they used when generating a 2-NDFL certificate? What data needs to be checked...used when generating a 2-NDFL certificate? What data needs to be checked... submission of 2-NDFL certificates by a tax agent in strict accordance with... the above, before submitting 2-NDFL certificates, tax agents need to carry out... Federation" section 2 of the 2-NDFL certificate, the taxpayer identification number is indicated (.. . completed information details in form 2-NDFL that do not correspond to reality, you can...

- About the procedure for filling out a certificate in form 2-NDFL

There is still time before submitting the certificate in form 2-NDFL, the employees of the controller... before filling out the certificate in form 2-NDFL, you need to make sure that your personal data is up to date... they believe that a certificate in form 2-NDFL with old personal data is... when filling out a certificate in form 2-NDFL. For which individuals should the organization... submit certificates in form 2-NDFL? The information is provided by tax agents - Russian... - the recipient of the income" certificate in form 2-NDFL must be filled out by the tax agent...

- Do I need to put a stamp on the 2-NDFL certificate?

The new form of certificate 2-NDFL is in force. Therefore, the question of whether it is necessary... is very relevant. As you know, the 2-NDFL certificate in the old form (valid until... the new form of the 2-NDFL certificate is in force. Therefore, the question is whether it is necessary... to affix a stamp on the 2-NDFL certificate before December 7, 2015... a new form of the 2-NDFL certificate and the procedure for filling it out were approved. New... of the year. In the new form of the 2-NDFL certificate, unlike the old form... a seal. Consequently, the new form of the 2-NDFL certificate does not require affixing the organization's seal ...

- New reporting on personal income and personal income tax amounts

On income - form 2-NDFL and certificate 2-NDFL. These are the ones to fill out and hand in. Form 2-NDFL. Form 2-NDFL is a new document for... numerical values. Filling out the fields of the 2-NDFL form with text, numeric, code values... . Submission of form 2-NDFL on paper. Forms 2-NDFL on paper... presentation of information). Forms 2-NDFL that have passed the completion control are considered submitted. Forms, ...). Submission of form 2-NDFL in electronic form. Forms 2-NDFL in electronic form...

- Introducing a new reporting form for personal income tax: 3-NDFL

On the income of an individual (f. 2-NDFL) and other income available to the taxpayer...

- Is it necessary to withhold personal income tax from payments to employees during one-day business trips?

FSS? Is it necessary to adjust Form 2-NDFL and Form 6-NDFL? What... -FSS? Is it necessary to adjust Form 2-NDFL and Form 6-NDFL? What... "Adjustment number". 3. 2-NDFL and 6-NDFL In case... are reflected in the certificate in form 2-NDFL (letter of the Ministry of Finance of Russia dated 18 ... tax withheld - in form 2-NDFL (hereinafter - certificate 2-NDFL) indicating in field... filling out the 2-NDFL certificate approved by the same order (hereinafter referred to as the Procedure for filling out 2-NDFL)) (see...

- Reorganization of the institution: personal income tax and insurance premiums

And submission of reports on forms 2-NDFL and 6-NDFL during reorganization... and submission of reports on forms 2-NDFL and 6-NDFL during reorganization... authority two certificates on form 2-NDFL: a certificate issued by the previous tax agent. .. /7-1089. Form 2-NDFL during reorganization When filling out form 2-NDFL you must... . So, in the certificate in form 2-NDFL, the successor of the tax agent indicates: a... submission of tax reports (on forms 2-NDFL, 6-NDFL), payment of taxes and...

- About the new option for filling out form 6-NDFL and errors when filling it out

Form 6-NDFL to the indicators of form 2-NDFL. According to the Control ratios to... data given in form 2-NDFL with sign “1”, ... the amount of income” of certificates in form 2-NDFL. Amount of accrued income (line... corresponding to the tax rate of 2-NDFL certificates with sign “1”, submitted by... income code 1010) of form 2-NDFL certificates with sign “1”, submitted... income 1010) certificates in form 2-NDFL with sign “1”, submitted... tax rate certificates in form 2-NDFL with sign “1”, submitted...

- Personal income tax. Getting ready for annual reporting

6-NDFL in specific situations. 2-NDFL Reporting information on the income of individuals...): “Desktop” – “Taxes” tab – “2-NDFL certificates to the tax office and employees.” In... only the 6-NDFL and 2-NDFL reports will be completed, it will be necessary to compare... the amount of income "in 2-NDFL (2-NDFL certificates with attribute 1 are taken into account ... in the line "Tax amount calculated" of the certificates 2-NDFL. "Number of income recipients": line 060... must be equal to the number of certificates 2-NDFL. "Withheld personal income tax": line 080 section...

- How does the date of payment of sick leave affect personal income tax reporting?

Benefits in 6-personal income tax and 2-personal income tax In part 2.1 of article..., 00 rub. Reflection of sick leave in 2-NDFL The amounts of benefits paid to the employee for... in annual certificates in form 2-NDFL must be reflected in section 3.... At the same time, there are discrepancies between certificates 2-NDFL and 6-NDFL for 2018...

Income of individuals according to form 2-NDFL and calculation according to form 6 ... income of individuals according to form 2-NDFL and calculation according to form 6 ... about income of an individual (form 2-NDFL), as well as calculation of tax amounts.. . income of individuals according to form 2-NDFL, calculation according to form 6-NDFL... income of individuals according to form 2-NDFL? (official website of the Federal Tax Service of the Russian Federation for... income of individuals in form 2-NDFL and calculation in form 6...

The most common document that reflects information about the income of individuals received from the employer is a certificate in form 2-NDFL. Each employee may need this document for various authorities. A certificate of income of individuals is required if an employee is going through the procedure of obtaining a loan from a bank, in legal disputes, or for submission to government agencies. In our article we will try to consider the main features associated with this certificate.

What is 2-NDFL?

2-NDFL is a standard form for an enterprise to report on income received by its employee, as well as on tax deductions provided and taxes that were withheld. As a rule, the certificate is prepared for the reporting year or six months. However, it can be obtained for any required period.

The information contained in the certificate may vary and depend on who receives this certificate - directly the employee himself or the Federal Tax Service.

The form of a certificate of income for an individual has a sample approved by the Federal Tax Service. However, it is recommended that you first familiarize yourself with the current, current version of the order in order to make sure that the form is up-to-date and not to fill out an outdated sample.

Information required to be displayed in the income certificate

The 2-NDFL certificate is issued to the employee by the organization that is his employer.

There are two main types of certificate, depending on the purpose:

1. For presentation to an individual (who is a current or already dismissed employee of the enterprise). Available upon request.

2. For submission to the Federal Tax Service as part of mandatory reporting.

The income certificate for individuals issued to an employee must contain the following data:

Help for reporting

A certificate can be submitted by an enterprise for the following types of tax reporting:

1. For all individuals who received income from this organization over the past reporting period (displayed in the form as feature No. 1).

2. For all individuals from whose income the company has not withheld personal income tax (displayed on the form as sign No. 2).

When filling out a certificate of income for an individual with characteristic No. 1, the following data must be contained:

- General information about the company issuing the certificate: name, individual taxpayer number, tax registration reason code.

- Monthly total income that is subject to personal income tax.

- Tax deductions.

- Full amounts of income for the reporting period, total data on taxes and deductions.

Certificate with sign No. 2

When submitting a tax certificate on the income of an individual with attribute No. 2, the following information must be displayed:

- General information about the enterprise issuing the certificate: name with an individual taxpayer number and a code that indicates the reason for registering the enterprise with tax authorities.

- General information about the person to whom the certificate is provided.

- Total total income from which no personal income tax was withheld.

- The amount of tax that was not withheld.

Where might this form be needed?

A 2-NDFL certificate on the income of an individual may be needed by an individual who is on the staff of an enterprise in the following cases:

1. When going through the procedure of applying for a loan at a bank.

2. In preparation for submitting and processing tax deductions to the Federal Tax Service.

3. When registering a pension with the Pension Fund of the Russian Federation.

4. When applying for social benefits by submitting an appropriate application to the social protection authorities.

5. During legal proceedings concerning labor issues or when determining the amount of alimony.

6. When a tax return is submitted to the Federal Tax Service (form 3-NDFL; required as a document confirming income).

7. When going through the procedure for registering guardianship.

8. When going through the visa procedure.

The enterprise must submit a certificate directly to the Federal Tax Service. It is provided for general monitoring of taxes on personal income, as well as for monitoring violations that may lead to an audit at the enterprise.

Features and procedure for submitting a 2-NDFL certificate

Submitting copies of income certificates for individuals is illegal. Therefore, it is issued only in its original form. Issue can be made not only to an employee who is a citizen of the Russian Federation, but also to a foreign citizen at his request.

Rules for submitting certificates to individuals

1. The legislative basis for issuance is the Labor and Tax Code of the Russian Federation.

2. The basis for issuing a certificate can be a written application from the employee (can be drawn up in free form).

3. The period during which this paper must be issued must not exceed three days after the date of writing the application requesting issue.

4. The certificate must be issued in the number of copies requested by the employee.

5. It can be presented either personally to the employee or by mail at the place of residence. Copies that are submitted in electronic form, as well as copies that do not bear the organization’s seal and the signature of an authorized person, are invalid.

A certificate of income of an individual is filled out according to the sample available in the organization.

Rules for submitting a certificate when reporting to the Federal Tax Service inspection

If a certificate with feature No. 1 is provided, the following rules must be observed:

- The legislative basis is the second paragraph of Article 230 of the Tax Code of the Russian Federation.

- Submission deadline: before the beginning of the second quarter of the year following the reporting year (that is, before April 1).

- A certificate of income of an individual (a sample of the form is presented above) must be submitted in the amount of one copy for each employee of the organization.

The following presentation methods are possible:

- By postal delivery.

- Via the Internet or on electronic media. In this case, an electronic signature of the organization is required. Accompanied by the provision of an explanatory register in the amount of two pieces.

In the case of submitting a certificate of income of individuals with sign No. 2, the following rules must be observed:

- The legislative basis is the fifth paragraph of Article No. 226 of the Tax Code of the Russian Federation.

- The basis for the submission is a requirement by law. Moreover, it has a mandatory procedure.

- Submission deadline: before the end of the first month following the reporting year in which payments were made without withholding personal income tax (that is, until January 31).

- Must be provided in duplicate for each employee. One is intended directly for the Federal Tax Service inspection, the second - for an employee of the enterprise.

The following delivery methods are possible:

- Personally by a representative of the organization.

- By postal delivery.

- Via the Internet or on electronic media. In this case, an electronic signature of the organization is required.

- For an individual - either in person or by post.

Possible liability for evading the submission of a 2-NDFL certificate

If an enterprise avoids submitting a certificate of the amount of income paid to an individual at the request of an employee or commits violations when issuing a certificate, then such actions can be assessed from two positions, each of which entails administrative liability:

1. Failure to issue a certificate (regulated by the third paragraph of Article 230 of the Tax Code and Article 62 of the Labor Code of the Russian Federation). In this case, in accordance with the Code of Administrative Offenses, the following preventive measures may be applied:

- An administrative fine may be imposed on the official responsible for issuing certificates. Ranges from 1 thousand rubles to 5 thousand rubles.

- An administrative fine may be imposed directly on the organization. Ranges from 30 thousand rubles to 50 thousand rubles.

- Freeze the organization's activities for up to three months.

2. Refusal to issue a certificate. In accordance with the Code of Administrative Offenses, an administrative fine may be imposed on the official responsible for issuing certificates in the amount of 1 thousand to 3 thousand rubles.

Certificate of the annual report for the Federal Tax Service

If we talk about submitting a summary certificate of income of individuals in the context of filing annual reports with the Federal Tax Service, then two cases can be differentiated:

1. Delay in filing (delay). For each certificate submitted untimely, a fine of two hundred rubles is imposed on the enterprise (in accordance with the first paragraph of Article 126 of the Tax Code of the Russian Federation).

2. Actions for failure to submit certificates requested by the Federal Tax Service, or deliberate distortion of the information contained in them (second paragraph of Article No. 126 of the Tax Code of the Russian Federation). If such actions are detected, the legislation provides for the imposition of a fine in an amount not exceeding 10 thousand rubles, and may also entail administrative punishment in the form of a fine on an official in the amount of 300 to 500 rubles.

Income tax return – tax rate, taxpayers and filing deadlines, as well as other important components. Recommendations from a lawyer for drawing up a 3-NDFL declaration and a corresponding sample for filling it out, which can be downloaded for free on our website.

Income tax is the main type of direct tax for citizens of the Russian Federation, calculated as a percentage of the total income of individuals minus documented expenses. As a rule, the income tax of an individual is withheld by a tax agent (for example, an employer), but in some cases the taxpayer is obliged to independently calculate and pay the tax, in these cases a tax return 3-NDFL is filled out.

Income tax rate and objects of taxation

In Russia, for many years there has been a fixed tax rate for the main types of income of an individual - 13%. In this case, basic income means income from hired work, from renting out housing, from work under a contract, etc. In addition, some types of income are subject to different rates: 35, 30 and 9%.

Tax on the income of an individual is calculated if there is a tax base and an object of taxation, which are:

- wage;

- dividends;

- winnings and prizes;

- rental income from real estate;

- income from material benefits and in kind;

- payments under insurance and pension agreements;

- interest on deposits in banks, if the amount exceeds the Central Bank refinancing rate;

- income from the sale of a car, securities and real estate;

- income from the sale of LLC shares and other property.

Important! Income that is not subject to taxation at the income tax rate is listed in Article 217 of the Tax Code of the Russian Federation.

It is worth noting that the taxpayer has the right to take advantage of tax deductions when paying income tax:

Standard- applied monthly in cases established by law.

Social- for training, medicines, pensions.

Property- when selling residential and commercial real estate and other property, when purchasing housing and land, with interest on targeted housing loans.

Deadlines for filing returns and paying income taxes

According to the general rule in force in the Russian Federation, the 3-NDFL tax return is submitted to the territorial inspectorate at the place of residence no later than April 30 of the current year following the reporting period. Exceptions are defined in paragraph 3 of Art. 229 of the Tax Code of the Russian Federation - if income payments are terminated before the end of the tax period, an individual must submit a report on actual income received to the tax office within five days from the date of termination of payments. The amount of tax calculated on the basis of the information in the taxpayer’s declaration must be paid by him no later than July 15 of the year following the reporting period. If the tax has been additionally assessed, its payment is made no later than 15 days from the date of filing the declaration.

Download tax return form 3-NDFL

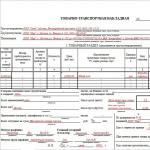

The income tax return consists of:

- title page

- several sections that are filled out on separate sheets in order to calculate the tax base and the amount of tax on income taxed at different rates;

Important! The title page and sections 1 and 2 of the declaration must be completed by all taxpayers submitting a report to the inspectorate. The remaining sections are completed only if necessary.

- sheets:

A- all income and sources of their payment within the Russian Federation received during the reporting period are indicated (income from business activities, lawyering and private practice is excluded); B- income and sources of payment outside the Russian Federation are indicated; IN- income from business and advocacy activities, private practice is indicated; G- used to calculate and reflect amounts of income that are not subject to tax; D1- used for calculating property tax deductions for expenses on new construction or acquisition of real estate; D 2- used for calculating property tax deductions for income from the sale of property and property rights; E1- used to calculate standard and social tax deductions; E2- is used to calculate social tax deductions established by subparagraphs 4 and 5 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation, as well as investment tax deductions established by Article 219.1 of the Tax Code of the Russian Federation; AND- is used to calculate professional tax deductions established by paragraphs 2, 3 of Article 221 of the Tax Code of the Russian Federation, as well as tax deductions established by paragraph two of subparagraph 2 of paragraph 2 of Article 220 of the Tax Code of the Russian Federation; Z- used to calculate taxable income from transactions with securities and transactions with derivative financial instruments (DF); AND- used to calculate taxable income from participation in investment partnerships.

Rules for filling out an income tax return

- the document may be completed using software or completed by hand in printed capital characters using blue or black ink;

- at the top of each page of the declaration the number and TIN of the taxpayer, his surname and initials must be indicated;

- at the bottom of each page of the document, with the exception of the title page, the date and signature of the taxpayer must be affixed;

- any amounts indicated in the declaration must have the value of whole rubles when rounding rules are used;

- corrections are not allowed in the declaration, as well as double-sided printing of the document;

- there is no need to print optional declaration pages if they have a zero value;

- The declaration must not be stapled or stapled using any means that may damage the paper.

Important! If an error was made in the return, correcting it is a necessary action for the taxpayer. An updated version of the declaration must also be submitted to the tax authorities as soon as possible.

Methods for filing a return with the tax authorities

Tax return 3-NDFL can be submitted to the inspectorate in the following ways:

- in paper form- 2 copies of the declaration are drawn up, one of which remains with the inspection, the second is given to the person who submitted the declaration with a note of acceptance of the document;

- by mail- the document is sent by registered mail with an inventory attached, the date of sending the letter will be considered the date of filing the declaration;

- electronic- carried out via the Internet using various operators that ensure the exchange of information between taxpayers and the Federal Tax Service.

The service allows you to:

- Prepare a report

- Generate file

- Test for errors

- Print report

- Send via Internet!

2-NDFL certificates in 2018: new form and sample filling

The form of the 2-NDFL certificate and the procedure for filling it out were approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485@ (as amended by the order of the Federal Tax Service of Russia dated January 17, 2018 No. ММВ-7-11/19@). It is valid throughout 2018. From January 1, 2019, the new certificate will be applied. It was approved by order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/566@.

Changes in the new form:

- drawn up on machine-readable form;

- for employees and for the Federal Tax Service is formed on different forms.

Who must prepare and submit 2-NDFL certificates

Certificates in form 2-NDFL must be submitted by organizations and individual entrepreneurs that pay income to individuals. This obligation is enshrined in clause 1, clause 2 of Art. 226 and paragraph 2 of Art. 230 Tax Code of the Russian Federation.

There is no need to submit 2-NDFL certificates if you paid to an individual:

Only non-taxable income (clause 28 of Article 217 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated January 19, 2017 No. BS-4-11/787@);

Income on which an individual must pay tax and submit a declaration (Article 227, Article 228 of the Tax Code of the Russian Federation);

Income specified in Art. 226.1 Tax Code of the Russian Federation.

If in the reporting (expired) year the organization did not pay an individual income from which personal income tax was required to be withheld, then a 2-NDFL (“zero”) certificate does not need to be submitted. For example, if only non-taxable income specified in Art. 217 Tax Code of the Russian Federation.

Where to submit 2-NDFL

In accordance with paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, tax agents submit reports on 2-NDFL to the tax authority at the place of their registration.

Submit 2-NDFL for employees of separate departments to the Federal Tax Service at the place of their registration. The same thing happens when a separate division pays income to individuals according to the GPA.

What income should be included in the 2-NDFL certificate 2018

How to fill out a 2-NDFL certificate

The general requirements for filling out the 2-NDFL certificate are as follows:

- 2-NDFL certificates are filled out by the tax agent based on the data contained in the tax registers.

- If the tax agent accrued income to an individual during the tax period that is taxed at different tax rates, sections 3-5 are completed for each rate.

- When filling out the Certificate form, codes for the types of income of the taxpayer, codes for the types of deductions of the taxpayer, the Directories “Codes of types of documents proving the identity of the taxpayer” (Appendix 1 of the Procedure for filling out the certificate) and “Codes of the subjects of the Russian Federation and other territories” (Appendix 2 of the Procedure for filling out the certificate) are used.

- All details and totals are filled in in the Certificate form. If there is no value for the total indicators, zero is indicated.

- Certificates in electronic form are generated in accordance with the format (xml) for submitting information on the income of individuals in form 2-NDFL.

Table 2. How to fill out 2-NDFL certificates

|

Chapter |

Information to be provided |

|

Heading |

Indicated: Tax period for which the Certificate form is prepared; Serial number of the Certificate in the reporting tax period; Date of preparation of the form; The “Sign” is indicated and the following is entered: number 1 - if Certificate 2-NDFL is submitted based on the provisions of clause 2 of Art. 230 Tax Code of the Russian Federation; number 2 - if the Certificate is submitted in accordance with the provisions of clause 5 of Art. 226 Tax Code of the Russian Federation. When drawing up the initial form of the Certificate, “00” is entered in the “Adjustment number” field; When drawing up a corrective Certificate to replace the previously submitted one, a value one more than that indicated in the previous Certificate is indicated (For example, “01”, “02”, etc.); When drawing up a canceling Certificate, the number “99” is entered instead of the previously submitted one. In the field “in the Federal Tax Service (code)” - the four-digit code of the tax authority with which the tax agent is registered. (Section II of the Procedure for filling out the certificate) |

|

Section 1 “Data about the tax agent” |

The OKTMO code and contact telephone number of the tax agent are indicated; TIN and checkpoint; name of the organization according to its constituent documents (Section III of the Procedure for filling out the certificate) |

|

Section 2 “Data about the individual - recipient of income” |

The TIN of the individual taxpayer is indicated; last name, first name and patronymic of the individual - taxpayer; taxpayer status code; Date of Birth; numeric code of the country of which the taxpayer is a citizen; code of the type of identification document and its details; full address of the taxpayer's place of residence; (Section IV of the Procedure for filling out the certificate) |

|

Section 3 “Income taxed at the rate of __%” |

information on income accrued and actually received by an individual in cash and in kind, as well as in the form of material benefits, by month of the tax period and corresponding deductions is indicated. (Section V of the Procedure for filling out the certificate) |

|

Section 4 “Standard, social, investment and property tax deductions” |

information about standard, social, investment and property tax deductions provided by the tax agent is reflected. (Section VI of the Procedure for filling out the certificate) |

|

Section 5 “Total Amounts of Income and Tax” |

the total amounts of accrued and actually received income, calculated, withheld and transferred personal income tax are reflected at the appropriate rate specified in the title of Section 3. (Section VII of the Procedure for filling out the certificate) |

How to fill out 2-NDFL in an accounting program

Let's consider the procedure for filling out certificates in accounting programs: Bukhsoft Online, 1C: Accounting and Kontur.Accounting.

Bukhsoft Online

1. Go to the “ ” module in the Funds/NDFL section and select “2-NDFL”.

2. In the window that opens, in the “Questionnaire” tab, fill out and check the employee’s information.

4. In the window that opens, reflect the data for sections 3-5 of the 2-NDFL certificate.

1C:Enterprise

1. Go to the section “Salaries and personnel/NDFL/2-NDFL for transfer to the Federal Tax Service”. Click "Create".

2. Fill out the header and signatures.

3. Then, using the “Fill” button, start the procedure for automatically collecting information about the income of individuals according to the information base. The list of prepared income certificates for individuals will be displayed in the tabular part of the document. When automatically filled out, the document includes only those amounts of income, deductions and taxes of individuals that relate to the OKTMO/KPP specified in the header of the document. If necessary, the data in the employee’s 2-NDFL document can be corrected manually, but instead it is recommended to correct the credentials themselves, and then refill the data in the document.

4. The data on the “Personal Data” tab is filled in automatically. If some personal data is not filled in or filled in incorrectly, you can directly change the employee’s personal data from the document form using the “Edit employee card” link. The edited data will be updated in the form automatically.

The details of the notification for tax reduction on advance payments (number, date of notification and code of the Federal Tax Service that issued it) are filled in automatically with the data specified in the document “Advance payment for personal income tax”.

5. After preparing the information, the document “2-NDFL for transfer to the Federal Tax Service” should be written down.

Kontur.Accounting

1. In the main program window, select the “Reporting” tab and click the “Create report” button.

2. In the window that opens, in the “Federal Tax” section, select the “2-NDFL” item. And indicate the reporting period.

In recent years, changes have been made to form 3-NDFL several times, but it is important to know that when filling out the declaration you must use the form that was valid in the calendar year for which you are filling out the declaration.

On this page you can download free 3-NDFL declaration forms for all recent years. Each sheet in the file contains a separate declaration page. You only need to complete the pages that are relevant to your situation.

You can print the form and fill it out by hand or use our online program to fill out 3-NDFL declarations. The program is built on the basis of simple questions (does not require special knowledge), and the filling process takes only 15-20 minutes.

Declaration form 3-NDFL for 2018

The tax return form for 2018 was adopted by Order of the Federal Tax Service of Russia dated October 3, 2018 No. ММВ-7-11/569@. The new form is significantly different from last year's declaration.

Declaration form 3-NDFL for 2017

The tax return form for 2017 was adopted by order of the Federal Tax Service of Russia dated October 25, 2017 No. ММВ-7-4/821@. The new form is almost no different from the declaration for last year (a few small changes were made).

Declaration form 3-NDFL for 2016

The tax return form for 2016 was adopted by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/552@. The new form is practically no different from the declaration for last year (only a few minor changes were made).

Declaration form 3-NDFL for 2015

The declaration form for 2015 was adopted by order of the Federal Tax Service of Russia dated November 25, 2015 N ММВ-7-11/544@. The new form is practically no different from the declaration for 2014 (only minor changes were made to it).

Declaration form 3-NDFL for 2014

The declaration form for 2014 was adopted by the Federal Tax Service of Russia No. ММВ-7-11/6712@ dated December 24, 2014 and will become effective on February 14, 2015. The declaration has been seriously revised compared to the previous form (the order of sheets and sections, their names have changed, and changes have been made to the structure of a number of sections).

Declaration form 3-NDFL for 2013

The declaration form for 2013 was adopted by Order of the Federal Tax Service of Russia dated November 14, 2013 N ММВ-7-3/501@. The only difference between the declaration for 2013 and the previous form is the replacement of OKATO codes with OKTMO codes.

Declaration form 3-NDFL for 2012/2011

For declarations for 2011 and 2012, a single form is used, adopted by order of the Federal Tax Service of Russia dated November 10, 2011 N ММВ-7-3/760@ “On approval of the tax return form for personal income tax (form 3-NDFL), Procedure its completion and format of the tax return for personal income tax (form 3-NDFL)." The main changes to the declaration were aimed at simplifying the filling process for taxpayers.

Declaration form 3-NDFL for 2010

The 3-NDFL declaration form for 2010 was adopted by Order of the Federal Tax Service of Russia dated November 25, 2010 No. ММВ-7-3/654@ “On approval of the tax return form for personal income tax (form 3-NDFL), the procedure for filling it out and format tax return for personal income tax (form 3-NDFL)".