A payslip of form T-51 is drawn up if an employee’s salary is transferred to a payment card of one of the banks. It cannot be used to pay an employee (unlike settlement and payment). Filling out payment and settlement forms is optional.

FILES

Conducted by whom

The responsibility for filling out this paper in the vast majority of cases falls on the payroll accountant. If there is only one accountant in the company, then it will be him. He must assign a serial number to each statement that is formed. It is more convenient to do this from the beginning of the year or reporting period, creating new ones every calendar month.

What documents are created based on it?

Information from the payroll goes to the payroll, and according to it, wages are calculated. Only the last column T-51 takes part in this process. In order to create it, you need a time sheet. All these documents are prepared for each employee separately.

Frequency of filling

In most cases, employees are paid twice a month. Such conditions are specified in the Labor Code of the Russian Federation; for violating it, the company risks incurring administrative liability. Moreover, the first payment is considered an advance payment (usually a percentage of the salary), and the second payment is considered the main payment (the remaining part of the amount). Thus, a simple payslip will be issued for the advance (it indicates the amount that was paid in the first half of the month).

Form T-51 serves to illustrate and document the main part of the payment of wages to employees of the institution.

The column “Retained and credited” in the tabular part of the document must also take into account the advance part - data from the first paper.

Approved by

This document was approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. A mention of this fact must be present on the form, in the upper right part.

Form

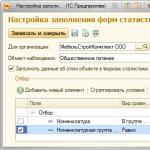

It is most convenient to fill out the document fields electronically, in the 1C program. It is imperative to convert the statement into paper version at least once a month. But it is also acceptable to keep it entirely in paper form.

If the work is carried out in 1C and some adjustment of the date is required (it needs to be created with a date other than the current one), then to do this, select the required number in the “Parameters” or select “Table”, then “View” and “Editing” and change the data of the desired cell in manual mode.

Filling algorithm

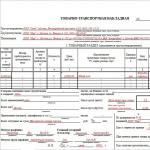

For full functionality, the paper can be issued in a single copy. At the top of the document fill out:

- Basic details. The OKPO code is already entered in the form - 0301010. OKUD is filled out.

- The full name of the company, if any, the structural division of the company within which the form is being filled out.

- The name of the statement, its number, the date of signatures.

- The period for which the calculations were made.

The date for drawing up the document can be chosen arbitrarily, but on the condition that this day will not be earlier than the last day in the current month and no later than the actual day the funds are written off from the organization's cash desk.

In addition, on the second page of the statement there is a table, each column of which must be filled in (otherwise a dash is placed in the table cell).

In total, the document contains 18 columns with the following names:

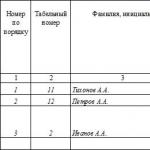

- serial number of the employee to whom the payment is intended;

- personnel number of the same employee;

- last name, first name and patronymic (the latter are abbreviated to initials);

- position held, profession or specialization in which the employee is engaged;

- salary or tariff rate;

- how many days or hours were worked during the specified period (weekends and weekdays are indicated separately);

- the amount accrued by the organization to this employee for the month (the column is divided into different types of fees, including a “general” column that summarizes the data);

- what amount was withheld and credited earlier (advance payment, income tax, etc.);

- the employee’s debts to the organization or, conversely, the exact amount;

- how much money is supposed to be paid to the employee according to this statement.

Signed by

The printed document must indicate the position, signature and transcript of the signature of the official who compiled the document. This could be the chief accountant or HR accountant.

ATTENTION! The statement will not be valid without the organization's seal on the last page.

By the way, according to the rules, it is permissible to fill out as many lines of the statement as necessary. It may have two, three, four or more sheets, compiled according to the sample tabular part of the paper.

Before receiving wages, the employee has the right to review the generated document at any time.

Nuances of filling

When filling out, the employee’s personnel number is automatically taken from his. The paper can be printed in a single copy. It is placed in the organization's archives. There should be no corrections on already completed paper. All necessary adjustments are made electronically.

If the performance of official duties does not require the employee to be in the office, then the statement goes to the company’s archives. It must be stored there, in accordance with established requirements, for at least 5 years.

Payment terms

After filling out the statement, the funds should reach the employee as soon as possible. The maximum permissible delay period is 5 working days. If the payment was not made on time, the statement will be marked “Deposited”.

Important point! The data in the document column “To be paid” must exactly match the column in the T-49 form “Amount”. If they are not equal, it means that an error has crept into the accounting calculations for the payment of wages.

The service allows you to:

- Prepare a report

- Generate file

- Test for errors

- Print report

- Send via Internet!

Form 4-FSS 2018 was approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381 (as amended on June 7, 2017). Since there is no new 4-FSS form from 2018, last year’s version of the form is used.

Calculation form for 4-FSS contributions for 2018

Form 4-FSS (4FSS) for 2017 (1st, 2nd, 3rd and 4th quarter)

On July 9, 2017, Order No. 275 of the FSS of Russia dated June 7, 2017 came into force, which made the following changes to Form 4-FSS:

- The field “Budgetary organization” has been added to the title page after the “OKVED Code” field.

- in Table 2, new lines appeared: “Debt owed by the reorganized policyholder and (or) a separate division of a legal entity deregistered” and “Debt owed by the territorial body of the Fund to the insured and (or) a separate division of a legal entity deregistered.”

Despite the fact that the order comes into force during the reporting period, according to the information message published on the Fund’s website on June 30, 2017, this order should be applied starting with reporting for 9 months of 2017.

4-FSS must be submitted in the form approved by Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381. This form is called “Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases.” It has been applied since the 1st quarter of 2017 and is still called 4-FSS, however, it does not have a section regarding insurance premiums for temporary disability and maternity. Since the inspectors receive all data on these contributions fromCalculation of insurance premiums to the Federal Tax Service .

Calculation form for 4-FSS contributions for the 1st quarter and half of 2017

Download a sample calculation form in MS Excel >>

Calculation form for 4-FSS contributions for 9 months and for the entire 2017

<Download a sample calculation form in MS Excel >>

Instructions for filling out Form 4-FSS

Filling out the cover page of the Calculation form

4. The title page of the Calculation form is filled out by the policyholder, except for the subsection “To be filled out by an employee of the territorial body of the Fund.”

5. When filling out the cover page of the Calculation form:

5.1. in the field "Insurant's registration number" the registration number of the insured is indicated;

5.2. the “Subordination Code” field consists of five cells and indicates the territorial body of the Fund in which the policyholder is currently registered;

5.3. in the "Adjustment number" field:

when submitting the primary Calculation, code 000 is indicated;

when submitted to the territorial body of the Settlement Fund, which reflects changes in accordance with Article 24 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” (Collection of Legislation of the Russian Federation, 1998 , N 31, Art. 3803; 2003, N 17, Art. 1554; 2014, N 49, Art. 6915; 2016, N 1, Art. 14; N 27, Art. 4183) (hereinafter referred to as the Federal Law of July 24 1998 N 125-FZ) (updated Calculation for the corresponding period), a number is entered indicating which account Calculation, taking into account the changes and additions made, is submitted by the policyholder to the territorial body of the Fund (for example: 001, 002, 003,...010 ).

The updated Calculation is presented in the form that was in force in the period for which errors (distortions) were identified;

5.4. in the “Reporting period (code)” field, the period for which the Calculation is being submitted and the number of requests from the policyholder for the allocation of the necessary funds for the payment of insurance compensation are entered.

When presenting the Calculation for the first quarter, half a year, nine months and a year, only the first two cells of the “Reporting period (code)” field are filled in. When applying for the allocation of the necessary funds for the payment of insurance coverage, only the last two cells are filled in the “Reporting period (code)” field.

Reporting periods are the first quarter, half a year and nine months of the calendar year, which are designated respectively as “03”, “06”, “09”. The billing period is the calendar year, which is designated by the number "12". The number of requests from the policyholder for the allocation of the necessary funds to pay insurance compensation is indicated as 01, 02, 03,... 10;

5.5. in the “Calendar year” field, enter the calendar year for the billing period of which the Calculation (adjusted calculation) is being submitted;

5.6. The field “Cessation of activities” is filled in only in the event of termination of the activities of the organization - the insured in connection with liquidation or termination of activities as an individual entrepreneur in accordance with paragraph 15 of Article 22.1 of the Federal Law of July 24, 1998 N 125-FZ (Collection of Legislation of the Russian Federation, 1998, No. 31, Article 3803; 2003, No. 17, Article 1554; 2016, No. 27, Article 4183). In these cases, the letter “L” is entered in this field;

5.7. in the field “Full name of the organization, separate subdivision/full name (last if available) of an individual entrepreneur, individual” the name of the organization is indicated in accordance with the constituent documents or a branch of a foreign organization operating in the territory of the Russian Federation, a separate subdivision; when submitting a Calculation by an individual entrepreneur, lawyer, notary engaged in private practice, the head of a peasant farm, an individual who is not recognized as an individual entrepreneur, his last name, first name, patronymic (the latter if available) (in full, without abbreviations) are indicated in accordance with the document , identification;

5.8. in the "TIN" field (taxpayer identification number (hereinafter - TIN)) the policyholder's TIN is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at its location in the territory of the Russian Federation.

For an individual who is not recognized as an individual entrepreneur (hereinafter - an individual), an individual entrepreneur, the TIN is indicated in accordance with the certificate of registration with the tax authority of the individual at the place of residence on the territory of the Russian Federation.

When an organization fills out a TIN, which consists of ten characters, in the area of twelve cells reserved for recording the TIN indicator, zeros (00) should be entered in the first two cells;

5.9. in the field "KPP" (reason code for registration) (hereinafter referred to as KPP) at the location of the organization, the KPP is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at the location in the territory Russian Federation.

The checkpoint at the location of the separate subdivision is indicated in accordance with the notice of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation at the location of the separate subdivision on the territory of the Russian Federation;

5.10. in the field "OGRN (OGRNIP)" the main state registration number (hereinafter referred to as OGRN) is indicated in accordance with the certificate of state registration of a legal entity formed in accordance with the legislation of the Russian Federation at its location on the territory of the Russian Federation.

For an individual entrepreneur, the main state registration number of an individual entrepreneur (hereinafter referred to as OGRNIP) is indicated in accordance with the certificate of state registration of an individual as an individual entrepreneur.

When filling out the OGRN of a legal entity, which consists of thirteen characters, in the area of fifteen cells reserved for recording the OGRN indicator, zeros (00) should be entered in the first two cells;

5.11. In the field "OKVED Code" the code is indicated according to the All-Russian Classifier of Economic Activities OK 029-2014 (NACE Rev. 2) for the main type of economic activity of the insured, determined in accordance with Decree of the Government of the Russian Federation dated December 1, 2005 N 713 "On approval of the Rules for classifying types of economic activities as professional risk" (Collected Legislation of the Russian Federation, 2005, No. 50, Art. 5300; 2010, No. 52, Art. 7104; 2011, No. 2, Art. 392; 2013, No. 13, Art. 1559; 2016, N 26, Art. 4057) and by order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 N 55 “On approval of the Procedure for confirming the main type of economic activity of the insurer for compulsory social insurance against accidents at work and professional diseases - a legal entity, as well as types of economic activities of the insurer's divisions, which are independent classification units" (registered by the Ministry of Justice of the Russian Federation on February 20, 2006, registration N 7522) as amended by orders of the Ministry of Health and Social Development of the Russian Federation dated August 1, 2008 N 376n (registered by the Ministry of Justice of the Russian Federation on August 15, 2008, registration N 12133), dated June 22, 2011 N 606n (registered by the Ministry of Justice of the Russian Federation on August 3, 2011, registration N 21550), dated October 25, 2011 No. 1212n (registered by the Ministry of Justice of the Russian Federation on February 20, 2012, registration No. 23266) (hereinafter referred to as Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55).

Newly created organizations - insurers for compulsory social insurance against industrial accidents and occupational diseases indicate a code according to the state registration authority, and starting from the second year of activity - a code confirmed in the prescribed manner in the territorial bodies of the Fund.

5.12. In the field "Budgetary organization: 1 - Federal budget 2 - Budget of a constituent entity of the Russian Federation 3 - Budget of a municipal entity 4 - Mixed financing" the attribute of the insurer being a budgetary organization is entered in accordance with the source of financing;

5.13. in the "Contact telephone number" field, indicate the city or mobile telephone number of the policyholder/successor or representative of the policyholder with the city code or cellular operator, respectively. The numbers are filled in in each cell without using the dash and parenthesis signs;

5.14. in the fields provided for indicating the registration address:

legal entities - legal address is indicated;

individuals, individual entrepreneurs - the registration address at the place of residence is indicated;

5.15. in the field "Average number of employees" the average number of employees is indicated, calculated in accordance with the federal statistical observation forms approved by the federal executive body authorized by the Government of the Russian Federation and instructions for filling them out (Part 4 of Article 6 of the Federal Law of November 29, 2007 N 282- Federal Law "On official statistical accounting and the system of state statistics in the Russian Federation" (Collected Legislation of the Russian Federation, 2007, N 49, Art. 6043; 2012, N 43, Art. 5784; 2013, N 27, Art. 3463; N 30, Art. 4084) (hereinafter referred to as Federal Law of November 29, 2007 N 282-FZ) for the period from the beginning of the year.

In the fields “Number of working disabled people”, “Number of workers engaged in work with harmful and (or) dangerous production factors” the list number of working disabled people, workers engaged in work with harmful and (or) dangerous production factors, calculated in accordance with federal statistical observation forms approved by the Government of the Russian Federation and instructions for filling them out (Part 4 of Article 6 of Federal Law No. 282-FZ of November 29, 2007) as of the reporting date;

5.16. information on the number of pages of the submitted Calculation and the number of attached sheets of supporting documents is indicated in the fields “Calculation submitted on” and “with the attachment of supporting documents or their copies on”;

5.17. in the field “I confirm the accuracy and completeness of the information specified in this calculation”:

in the field “1 - policyholder”, “2 – representative of the policyholder”, “3 – legal successor”, if the accuracy and completeness of the information contained in the Calculation is confirmed by the head of the organization, individual entrepreneur or individual, the number “1” is entered; in case of confirmation of the accuracy and completeness of the information, the representative of the policyholder enters the number “2”; if the accuracy and completeness of the information is confirmed, the legal successor of the liquidated organization enters the number “3”;

in the field “Full name (last if available) of the head of the organization, individual entrepreneur, individual, representative of the policyholder” when confirming the accuracy and completeness of the information contained in the Calculation:

- - by the head of the organization - the policyholder/legal successor - the surname, first name, patronymic (last if available) of the head of the organization is indicated completely in accordance with the constituent documents;

- by an individual, individual entrepreneur - indicate the surname, first name, patronymic (last if available) of the individual, individual entrepreneur;

- representative of the policyholder/successor - an individual - indicate the surname, first name, patronymic (last if available) of the individual in accordance with the identity document;

- representative of the insured/legal successor - legal entity - the name of this legal entity is indicated in accordance with the constituent documents, the seal of the organization is affixed;

in the fields "Signature", "Date", "M.P." the signature of the policyholder/successor or his representative is affixed, the date of signing the Calculation; if the organization submits the Calculation, a stamp is affixed (if any);

in the field "Document confirming the authority of the representative" the type of document confirming the authority of the representative of the policyholder/legal successor is indicated;

5.18. The field “To be filled in by an employee of the territorial body of the Fund Information on the submission of the calculation” is filled in when submitting the Calculation on paper:

in the field "This calculation is submitted (code)" the method of presentation is indicated ("01" - on paper, "02" - by post);

in the field “with the attachment of supporting documents or their copies on sheets” the number of sheets, supporting documents or their copies attached to the Calculation is indicated;

In the field "Date of submission of calculation" the following is entered:

date of submission of the Calculation in person or through a representative of the policyholder;

date of sending the postal item with a description of the attachment when sending the Calculation by mail.

In addition, this section indicates the last name, first name and patronymic (if any) of the employee of the territorial body of the Fund who accepted the Calculation, and puts his signature.

Filling out Table 1 "Calculation of the base for calculating insurance premiums" of the Calculation form

7. When filling out the table:

7.1. line 1 in the corresponding columns reflects the amounts of payments and other remuneration accrued in favor of individuals in accordance with Article 20.1 of the Federal Law of July 24, 1998 N 125-FZ on an accrual basis from the beginning of the billing period and for each of the last three months of the reporting period ;

7.2. in line 2 in the corresponding columns the amounts not subject to insurance premiums are reflected in accordance with Article 20.2 of the Federal Law of July 24, 1998 N 125-FZ;

7.3. line 3 reflects the base for calculating insurance premiums, which is defined as the difference in line indicators (line 1 - line 2);

7.4. line 4 in the corresponding columns reflects the amount of payments in favor of working disabled people;

7.5. line 5 indicates the amount of the insurance tariff, which is set depending on the class of professional risk to which the insured belongs (separate division);

7.6. in line 6 the percentage of the discount to the insurance rate established by the territorial body of the Fund for the current calendar year is entered in accordance with the Rules for establishing discounts and surcharges for policyholders to insurance rates for compulsory social insurance against industrial accidents and occupational diseases, approved by the Decree of the Government of the Russian Federation dated 30 May 2012 N 524 “On approval of the Rules for establishing discounts and surcharges for policyholders on insurance rates for compulsory social insurance against industrial accidents and occupational diseases” (Collected Legislation of the Russian Federation, 2012, N 23, Art. 3021; 2013, N 22 , Art. 2809; 2014, No. 32, Art. 4499) (hereinafter referred to as Decree of the Government of the Russian Federation of May 30, 2012 No. 524);

7.7. line 7 indicates the percentage of the premium to the insurance rate established by the territorial body of the Fund for the current calendar year in accordance with Decree of the Government of the Russian Federation dated May 30, 2012 N 524;

7.8. line 8 indicates the date of the order of the territorial body of the Fund to establish an additional premium to the insurance tariff for the policyholder (separate unit);

7.9. line 9 indicates the amount of the insurance rate, taking into account the established discount or surcharge to the insurance rate. The data is filled in with two decimal places after the decimal point.

Filling out table 1.1 "Information required for calculating insurance premiums by policyholders specified in paragraph 2.1 of Article 22 of the Federal Law of July 24, 1998 N 125-FZ" of the Calculation form

9. When filling out the table:

9.1. the number of completed lines in Table 1.1 must correspond to the number of legal entities or individual entrepreneurs to which the insurer temporarily sent its employees under an agreement on the provision of labor for workers (personnel) in cases and under the conditions established by the Labor Code of the Russian Federation, the Law of the Russian Federation of April 19, 1991 year N 1032-1 “On employment of the population in the Russian Federation” (hereinafter referred to as the agreement), other federal laws;

9.2. in columns 2, 3, 4, the registration number in the Fund, TIN and OKVED of the receiving legal entity or individual entrepreneur are indicated respectively;

9.3. Column 5 indicates the total number of employees temporarily assigned under a contract to work for a specific legal entity or individual entrepreneur;

9.4. Column 6 reflects payments in favor of employees temporarily assigned under a contract, from whom insurance premiums are charged, on an accrual basis, respectively, for the first quarter, half a year, 9 months of the current period and the year;

9.5. Column 7 reflects payments in favor of working disabled people temporarily assigned under a contract, from whom insurance premiums are calculated, on an accrual basis, respectively, for the first quarter, half a year, 9 months of the current period and the year;

9.6. columns 8, 10, 12 reflect payments in favor of employees temporarily assigned under a contract, from whom insurance premiums are calculated, on a monthly basis;

9.7. in columns 9, 11, 13, payments in favor of working disabled people temporarily assigned under a contract, from whom insurance premiums are calculated, on a monthly basis;

9.8. Column 14 indicates the amount of the insurance rate, which is set depending on the class of professional risk to which the receiving legal entity or individual entrepreneur belongs;

9.9. Column 15 indicates the amount of the insurance rate of the receiving legal entity or individual entrepreneur, taking into account the established discount or surcharge to the insurance rate. The data is filled in with two decimal places after the decimal point.

Filling out Table 2 “Calculations for compulsory social insurance against accidents at work and occupational diseases” of the Calculation form

10. The table is filled out based on the policyholder’s accounting records.

11. When filling out the table:

11.1. Line 1 reflects the amount of debt for insurance premiums from industrial accidents and occupational diseases that the insurer has accumulated at the beginning of the billing period.

This indicator should be equal to the indicator of line 19 for the previous billing period, which does not change during the billing period;

- on line 1.1 in accordance with Article 23 of the Federal Law of July 24, 1998 N 125-FZ, the policyholder - legal successor reflects the amount of debt transferred to him from the reorganized insurer in connection with the succession, and (or) the legal entity reflects the amount of debt deregistered separate division;

11.2. line 2 reflects the amount of accrued insurance contributions for compulsory social insurance against accidents at work and occupational diseases from the beginning of the billing period in accordance with the amount of the established insurance tariff, taking into account the discount (surcharge). The amount is divided “at the beginning of the reporting period” and “for the last three months of the reporting period”;

11.3. line 3 reflects the amount of contributions accrued by the territorial body of the Fund based on reports of on-site and desk audits;

11.4. line 4 reflects the amounts of expenses not accepted for offset by the territorial body of the Fund for past billing periods based on reports of on-site and desk inspections;

11.5. line 5 reflects the amount of insurance premiums accrued for previous billing periods by the policyholder, subject to payment to the territorial body of the Fund;

11.6. line 6 reflects the amounts received from the territorial body of the Fund to the bank account of the policyholder in order to reimburse expenses exceeding the amount of accrued insurance premiums;

11.7. line 7 reflects the amounts transferred by the territorial body of the Fund to the policyholder’s bank account as a return of overpaid (collected) amounts of insurance premiums, offset of the amount of overpaid (collected) insurance premiums to pay off the debt on penalties and fines to be collected.

11.8. line 8 - control line, where the sum of the values of lines 1 to 7 is indicated;

11.9. Line 9 shows the amount of debt at the end of the reporting (calculation) period based on the policyholder’s accounting data:

line 10 reflects the amount of debt owed to the territorial body of the Fund at the end of the reporting (calculation) period, formed due to the excess of expenses incurred for compulsory social insurance against accidents at work and occupational diseases over the amount of insurance premiums subject to transfer to the territorial body of the Fund;

line 11 reflects the amount of debt owed to the territorial body of the Fund, formed due to the amounts of insurance premiums overpaid by the policyholder at the end of the reporting period;

11.10. Line 12 shows the amount of debt at the beginning of the billing period:

line 13 reflects the amount of debt owed to the territorial body of the Fund at the beginning of the billing period, formed due to the excess of expenses for compulsory social insurance against industrial accidents and occupational diseases over the amount of insurance contributions subject to transfer to the territorial body of the Fund, which during the billing period did not changes (based on the policyholder’s accounting data);

line 14 reflects the amount of debt owed to the territorial body of the Fund, formed due to the amounts of insurance premiums overpaid by the policyholder at the beginning of the billing period;

11.11. the indicator of line 12 must be equal to the indicator of lines 9 of the Calculation for the previous billing period;

- on line 14.1, the policyholder - legal successor reflects the amount of debt owed to the territorial body of the Fund, transferred to it from the reorganized policyholder in connection with the succession and (or) the legal entity reflects the amount of debt owed to the territorial body of the Fund of the deregistered separate division;

11.12. line 15 reflects the costs of compulsory social insurance against industrial accidents and occupational diseases on an accrual basis from the beginning of the year, broken down “at the beginning of the reporting period” and “for the last three months of the reporting period”;

11.13. line 16 reflects the amounts of insurance premiums transferred by the policyholder to the personal account of the territorial body of the Fund, opened with the Federal Treasury, indicating the date and number of the payment order;

11.14. line 17 reflects the written off amount of the insured's debt in accordance with the regulatory legal acts of the Russian Federation adopted in relation to specific policyholders or the industry for writing off arrears, as well as the amount of debt written off in accordance with Part 1 of Article 26.10 of the Federal Law of July 24, 1998. N 125-FZ;

11.15. line 18 - control line, which shows the sum of the values of lines 12, 14.1 - 17;

11.16. line 19 reflects the debt owed by the policyholder at the end of the reporting (calculation) period based on the policyholder's accounting data, including arrears (line 20).

Filling out Table 3 "Expenses for compulsory social insurance against accidents at work and occupational diseases" of the Calculation form

12. When filling out the table:

12.1. Lines 1, 4, 7 reflect the expenses incurred by the policyholder in accordance with the current regulatory legal acts on compulsory social insurance against industrial accidents and occupational diseases, of which:

on lines 2, 5 - expenses incurred by the insured to the injured person working outside;

on lines 3, 6, 8 - expenses incurred by the insured who suffered in another organization;

12.2. Line 9 reflects expenses incurred by the insurer to finance preventive measures to reduce industrial injuries and occupational diseases. These expenses are made in accordance with the Rules for financial support of preventive measures to reduce industrial injuries and occupational diseases of workers and sanatorium and resort treatment of workers engaged in work with harmful and (or) dangerous production factors, approved by order of the Ministry of Labor and Social Protection of the Russian Federation dated 10 December 2012 N 580н (registered by the Ministry of Justice of the Russian Federation on December 29, 2012, registration N 26440) as amended by orders of the Ministry of Labor and Social Protection of the Russian Federation dated May 24, 2013 N 220н (registered by the Ministry of Justice of the Russian Federation on July 2 2013, registration N 28964), dated February 20, 2014 N 103n (registered by the Ministry of Justice of the Russian Federation on May 15, 2014, registration N 32284), dated April 29, 2016 N 201n (registered by the Ministry of Justice of the Russian Federation on August 1 2016, registration N 43040), dated July 14, 2016 N 353n (registered by the Ministry of Justice of the Russian Federation on August 8, 2016, registration N 43140);

12.3. line 10 - control line, which shows the sum of the values of lines 1, 4, 7, 9;

12.4. line 11 reflects for information purposes the amount of accrued and unpaid benefits, with the exception of the amounts of benefits accrued for the last month of the reporting period, in respect of which the deadline for payment of benefits established by the legislation of the Russian Federation was not missed;

12.5. Column 3 shows the number of paid days for temporary disability due to an industrial accident or occupational disease (vacation for spa treatment);

12.6. Column 4 reflects cumulative expenses from the beginning of the year, offset against insurance contributions for compulsory social insurance against industrial accidents and occupational diseases.

Filling out table 4 "Number of victims (insured) in connection with insured events in the reporting period" of the Calculation form

13. When filling out the table:

13.1. on line 1, the data is filled out on the basis of reports of industrial accidents in form N-1 (Appendix No. 1 to the resolution of the Ministry of Labor and Social Development of the Russian Federation dated October 24, 2002 No. 73 “On approval of document forms required for investigation and recording accidents at work, and provisions on the specifics of investigating accidents at work in certain industries and organizations" (registered by the Ministry of Justice of the Russian Federation on December 5, 2002, registration No. 3999) as amended by order of the Ministry of Labor and Social Protection of the Russian Federation dated 20 February 2014 N 103n (registered by the Ministry of Justice of the Russian Federation on May 15, 2014, registration N 32284), highlighting the number of fatal cases (line 2);

13.2. on line 3, the data is filled in on the basis of reports on cases of occupational diseases (appendix to the Regulations on the investigation and recording of occupational diseases, approved by Decree of the Government of the Russian Federation of December 15, 2000 N 967 “On approval of the Regulations on the investigation and recording of occupational diseases” (Collected Legislation Russian Federation, 2000, No. 52, Article 5149; 2015, No. 1, Article 262).

13.3. line 4 reflects the sum of the values of lines 1, 3, highlighting on line 5 the number of victims (insured) in cases that resulted only in temporary disability. The data on line 5 is filled in on the basis of certificates of incapacity for work;

13.4. When filling out lines 1 - 3, which are filled out on the basis of reports on industrial accidents in form N-1 and reports on cases of occupational diseases, insured events for the reporting period should be taken into account on the date of the examination to verify the occurrence of the insured event.

Filling out Table 5 “Information on the results of a special assessment of working conditions and mandatory preliminary and periodic medical examinations of workers at the beginning of the year” of the Calculation form

14. When filling out the table:

14.1. on line 1 in column 3, data on the total number of employer’s jobs subject to a special assessment of working conditions is indicated, regardless of whether a special assessment of working conditions was carried out or not;

on line 1 in columns 4 - 6, data on the number of jobs in respect of which a special assessment of working conditions was carried out, including those classified as harmful and dangerous working conditions, contained in the report on the special assessment of working conditions; if a special assessment of working conditions was not carried out by the insured, then “0” is entered in columns 4 - 6.

In the event that the validity period of the results of certification of workplaces for working conditions, carried out in accordance with the Federal Law of December 28, 2013 N 426-FZ "On Special Assessment of Working Conditions" (Collection of Legislation of the Russian Federation, 2013) , N 52, Art. 6991; 2014, N 26, Art. 3366; 2015, N 29, Art. 4342; 2016, N 18, Art. 2512) (hereinafter referred to as Federal Law of December 28, 2013 N 426-FZ ) order, has not expired, then on line 1 in columns 4 - 6 in accordance with Article 27 of the Federal Law of December 28, 2013 N 426-FZ, information based on this certification is indicated.

14.2. on line 2, columns 7 - 8 indicate data on the number of workers engaged in work with harmful and (or) hazardous production factors who are subject to and have undergone mandatory preliminary and periodic inspections.

Columns 7 - 8 are filled out in accordance with the information contained in the final acts of the medical commission based on the results of periodic medical examinations (examinations) of workers (clause 42 of the Procedure for conducting mandatory preliminary (upon entry to work) and periodic medical examinations (examinations) of workers employed in heavy labor work and work with harmful and (or) dangerous working conditions, approved by order of the Ministry of Health and Social Development of the Russian Federation dated April 12, 2011 N 302n (registered by the Ministry of Justice of the Russian Federation on October 21, 2011, registration N 22111) as amended, introduced by orders of the Ministry of Health of the Russian Federation dated May 15, 2013 N 296n (registered by the Ministry of Justice of the Russian Federation on July 3, 2013, registration N 28970), dated December 5, 2014 N 801n (registered by the Ministry of Justice of the Russian Federation on February 3, 2015 , registration N 35848) (hereinafter referred to as the Procedure) and in accordance with the information contained in the conclusions based on the results of a preliminary medical examination issued to employees who have undergone these examinations over the previous year (clause 12 of the Procedure);

14.3. Column 7 indicates the total number of employees engaged in work with harmful and (or) hazardous production factors, subject to mandatory preliminary and periodic inspections;

14.4. Column 8 indicates the number of employees engaged in work with harmful and (or) hazardous production factors who have undergone mandatory preliminary and periodic inspections.

In this case, the results of mandatory preliminary and periodic medical examinations of workers as of the beginning of the year should be taken into account, taking into account that, according to paragraph 15 of the Procedure, the frequency of periodic medical examinations is determined by the types of harmful and (or) hazardous production factors affecting the employee, or the types of work performed .

Form 4-FSS (4FSS) for 2016 (1st, 2nd, 3rd, 4th quarter)

Form 4-FSS was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated February 26, 2015 No. 59 “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and professional diseases, as well as the costs of paying insurance coverage and the procedure for filling it out.” Latest changes in the spring by Order of the Social Insurance Fund of the Russian Federation dated July 4, 2016 No. 260 “On introducing amendments to Appendices No. 1 and No. 2 to the Order of the Social Insurance Fund of the Russian Federation dated February 26, 2015 No. 59 “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage and the Procedure for filling it out "" (as amended on 07/04/2016 ).

Attention! The FSS has approved a new format for submitting the 4-FSS report, starting with reporting for 9 months of 2016.

The change in format was approved by Order No. 386 dated September 29, 2016 “On amendments to the Technology for accepting payments from policyholders for accrued and paid insurance premiums in the system of the Social Insurance Fund of the Russian Federation in electronic form using an electronic signature, approved by order of the Social Insurance Fund of the Russian Federation dated February 12 2010 No. 19"

From reporting for 9 months of 2016 (3rd quarter), file 4-FSS is presented in the new format “0.9”.

The 4-FSS report for the 1st quarter and half-year, if necessary, will be submitted in the same format, “0.8”.

Form 4-FSS (4FSS) for 2015 (1st, 2nd, 3rd, 4th quarter)

Form 4-FSS for 2015 was approved by Order of the Social Insurance Fund of the Russian Federation dated February 26, 2015 No. 59 “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance from accidents at work and occupational diseases, as well as the costs of paying insurance coverage and the procedure for filling it out.”

Form 4-FSS (4FSS) for 2014 (1st, 2nd, 3rd, 4th quarter)

Order of the Ministry of Labor of Russia No. 94 dated February 11, 2014 amended appendices No. 1 and 2 to the order of the Ministry of Labor and Social Protection of the Russian Federation dated March 19, 2013 No. 107n “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage and the Procedure for filling it out.”

Main changes:

- the "OKATO code" field on the title page has been eliminated;

- Table 3 “Calculation of the base for calculating insurance premiums” has been changed;

- added table 4.5 "Information necessary for the application of the reduced tariff of insurance premiums by the payers of insurance premiums specified in paragraph 14 of part 1 of article 58 of the Federal Law of July 24, 2009 N 212-FZ";

- table 10 “Information on the results of certification of workplaces for working conditions and mandatory preliminary and periodic medical examinations of workers at the beginning of the year” has been changed;

- The filling order has been changed.

More information about the calculation of insurance premiums according to Form 4-FSS for 2013

Documents by form

Order of the Ministry of Labor of Russia No. 107n dated March 19, 2013 (registered with the Ministry of Justice of Russia on May 22, 2013 N 28466) approved a new form of reporting on insurance contributions for compulsory social insurance (form 4-FSS).

The new form comes into effect with reporting for the first half of 2013 and contains an additional table to reflect information on certification of workplaces for working conditions and mandatory preliminary and periodic medical examinations. This information is taken into account when determining the size of the discount or surcharge to the insurance rate established by the Federal Insurance Service of the Russian Federation.

Electronic reporting via the Internet to the Social Insurance Fund

Order of the FSS of the Russian Federation dated 02/12/2010 No. 19 “On the introduction of secure exchange of documents in electronic form using an electronic digital signature for the purposes of compulsory social insurance” (as amended by Orders of the FSS of the Russian Federation dated 04/06/2010 N 57, dated 09/24/2010 N 195, dated 03/21/2011 N 53, dated 06/14/2011 N 148, dated 03/14/2012 N 87) approved the technology for accepting payments from policyholders for accrued and paid insurance premiums in the system of the Social Insurance Fund of the Russian Federation in electronic form using an electronic digital signature.

Insurers whose average number of individuals, in whose favor payments and other remunerations are made, for the previous billing period exceeds 50 people, as well as newly created (including during reorganization) organizations whose number of specified individuals exceeds this limit are required to provide report in electronic form with an electronic digital signature.

You can use Sending Reports via the Internet right now!

Report on Form 4a-FSS is now for individual entrepreneurs

A report in form 4a-FSS, approved by order of the Ministry of Health and Social Development of Russia dated October 26, 2009 N 847n, is provided annually. It is provided by lawyers, individual entrepreneurs, members of peasant (farm) households, notaries engaged in private practice, other persons engaged in private practice, members of family (tribal) communities of indigenous peoples of the North who have voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity in accordance with Article 4.8 of the Federal Law of December 29, 2006 N 255-FZ.

More information about calculating insurance premiums using Form 4-FSS for previous years

Calculation of insurance premiums according to form 4-FSS for 2012

The Ministry of Health and Social Development of Russia developed Order No. 216n dated March 12, 2012 “On approval of the form of calculation for accrued and paid insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against industrial accidents and occupational diseases, as well as on the costs of paying insurance coverage and the procedure for filling it out"

- Download the FSS recommended procedure for filling out form 4-FSS 2012

Calculation of insurance premiums according to form 4-FSS for 2011

The Ministry of Health and Social Development of Russia developed Order No. 156n dated February 28, 2011 “On approval of the form of calculation for accrued and paid insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against industrial accidents and occupational diseases, as well as on the costs of paying insurance coverage and the procedure for filling it out"

- Download the FSS recommended procedure for filling out form 4-FSS 2011

Calculation of insurance premiums according to form 4-FSS for 2010

Order of the Ministry of Health and Social Development of Russia dated November 6, 2009 N 871n was adopted, which approved the form of quarterly reporting to the Social Insurance Fund for 2010 “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance from accidents at work and occupational diseases, as well as the costs of paying insurance coverage"

Calculation of insurance premiums according to form 4-FSS valid until 2009

The procedure for filling out a report on insurance premiums voluntarily paid to the FSS of the Russian Federation by certain categories of insurers (form 4a-FSS) was approved by Resolution of the FSS of the Russian Federation dated 04/25/2003 N 46 (as amended by Resolution of the FSS of the Russian Federation dated 01/19/07 No. 11, dated 04/13/2009 No. 92)

The procedure for filling out the payroll using the funds of the Social Insurance Fund of the Russian Federation in 2009 (form 4-FSS), approved by the resolution of the Federal Insurance Fund of the Russian Federation dated December 22, 2004 No. 111 (as amended by resolutions dated March 31, 2006 No. 37, dated January 19, 2007 No. 11, dated 27.07.2007 No. 165, dated 21.08.2007 No. 192, dated 13.04.2009 No. 92)

24.12.18

Reporting on insurance premiums and personalized accounting is mandatory for submission to the Federal Tax Service and state extra-budgetary funds, which means that late submission or non-submission of reports, as well as detected errors and inaccuracies, serve as the basis for regulatory authorities to apply penalties. 3 05612.12.18

The deadline for submitting insurance premiums for the year depends on what report needs to be submitted and to which authority. The deadline for submitting a report on social insurance contributions depends on the method of submitting the report - on paper or electronically. We will learn from this article by what time it is necessary to submit annual reports on contributions so as not to cause complaints from inspectors. 5 26331.10.18

In October, organizations will provide calculations for insurance premiums and 4-FSS. The regulatory authorities remind us of the need for timely submission of reports within strictly established deadlines, both electronically and on paper, and urges organizations to prepare reports in accordance with relevant and necessary clarifications and legal norms, otherwise they promise penalties. 1 88420.08.18

Based on the results of a desk audit, the FSS revealed untimely submission of a report on Form 4-FSS for the 3rd quarter of 2017 and fined the company 208 thousand rubles (5% of the amount of contributions accrued for payment over the last three months). The company explained that the reason for the violation of the reporting deadline was damage to the hard drive of the computer on which the software package was installed, and asked the court to cancel the fine in full. Courts of three... 53512.07.18

The company sent to the Social Insurance Fund a calculation in form 4-FSS for 9 months of 2016 in a no longer relevant form (without taking into account changes based on the fund’s order No. 260 dated July 4, 2016). The Fund refused to accept the calculation and, due to the subsequent untimely (with a delay of 4 days) submission of the corrected calculation, fined the company under paragraph 1 of Article 19 of Law 125-FZ for 1 thousand rubles. Courts of two instances (case No. A50-35616/2017) overturned the fund's decision... 58306.07.18

Are gifts to employees reflected in the calculation of insurance premiums and in the calculation of Form 4-FSS if the gift amount is less than 4,000 rubles? What documents are required to formalize the issuance of gifts to employees (a gift agreement has been concluded with each employee)? 4 95818.06.18

The Ministry of Labor plans to make changes to the administrative regulations of the Social Insurance Fund for the provision of public services for accepting calculations of contributions for injuries in the 4-FSS form, approved by Order No. 288n dated March 20, 2017. The text of the draft amendments has been published. One of the clauses of the regulations will indicate that the calculation received by the territorial body of the Social Insurance Fund through the multifunctional center must contain notes from the responsible employee of the center about the registration of the calculation... 52414.02.18

The employees were given holiday gifts in cash, and a gift agreement was concluded with each of them. The gift amount does not exceed 4000 rubles. We believe that gifts are not subject to personal income tax, contributions to the Pension Fund of the Russian Federation, the Federal Social Insurance Fund of the Russian Federation, compulsory medical insurance and insurance premiums against accidents and industrial diseases. The gifts were issued according to payroll T-53, which is intended to pay salaries. Is this legal? What is the procedure for reflecting the value of gifts in 4-FSS and ERSV reports? 2 95005.10.17

Accountants are required to provide 4-FSS reporting for the third quarter of 2017 in an updated form. Therefore, we will consider the rules and requirements for filling out the new document, as well as the deadlines for submitting reports. 5 66402.10.17

In accordance with paragraph 1 of Art. 24 of Federal Law No. 125-FZ, policyholders submit quarterly, in accordance with the established procedure, to the territorial body of the insurer at the place of their registration a calculation of insurance premiums (in Form 4-FSS). Starting from reporting for the nine months of 2017, the calculation is submitted in an updated form, taking into account the amendments made by Order of the Federal Social Insurance Fund of the Russian Federation dated 06/07/2017 No. 275 (Information of the Federal Social Insurance Fund of the Russian Federation dated 06/30/2017). Below we will tell you what has changed and what nuances you should pay attention to. 11 30420.09.17

By Order No. 416 dated September 11, 2017, the FSS introduced changes to the technology for accepting insurers’ settlements for accrued and paid insurance premiums (that is, 4-FSS settlements) in electronic form using an electronic signature. The table "Details of the element "Title" is supplemented with the line "Source of financing of a budgetary organization" (BO_IF). If it is not there (that is, if there is no data "Source of financing of a budgetary organization" or in case of equality... 1 38020.09.17

Order of the Federal Insurance Fund of the Russian Federation dated September 11, 2017 N 416 “On introducing changes to the Technology for accepting payments from policyholders for accrued and paid insurance premiums in the system of the Social Insurance Fund of the Russian Federation in electronic form using an electronic signature, approved by the Order of the Social Insurance Fund of the Russian Federation dated February 12, 2010 city N 19" 67603.07.17

The FSS has released information about the start of application of the updated version of form 4-FSS. Changes to it were made by order of the FSS dated 06/07/2017 No. 275, which was recently registered with the Ministry of Justice. This order was officially published on www.pravo.gov.ru on June 28, 2017 and comes into force after 10 days from the date of publication. However, given that the order comes into force on the date after the start of the reporting campaign, this... 1 57103.07.17

Information from the Federal Social Insurance Fund of the Russian Federation dated June 30, 2017 98129.06.17

By order of June 7, 2017 N 275, the FSS amended appendices N 1 and N 2 to its order of September 26, 2016 N 381, which approved Form 4-FSS - a form for calculating accrued and paid contributions for compulsory social insurance against accidents cases at work and occupational diseases, as well as the costs of paying insurance coverage. The amendments will come into force on July 9. The title page of the form is supplemented with several lines for budget... 1 2 85616.05.17

By Order No. 288n dated March 20, 2017, the Ministry of Labor approved the administrative regulations of the Social Insurance Fund for the provision of public services for accepting payments for accrued and paid contributions for compulsory social insurance against industrial accidents and occupational diseases, as well as for expenses for the payment of insurance coverage (Form 4-FSS). The document will come into force on May 22, at which time a similar order of the Ministry of Labor dated September 18, 2013 N 467n will no longer be in force. Regulations... 68916.05.17

Order of the Ministry of Labor of Russia dated March 20, 2017 N 288n “On approval of the Administrative Regulations of the Social Insurance Fund of the Russian Federation for the provision of public services for accepting payments for accrued and paid insurance contributions for compulsory social insurance against industrial accidents and occupational diseases, as well as for expenses for payment of insurance coverage (form 4-FSS)" 1 05303.05.17

Administration of insurance premiums this year was transferred to the Federal Tax Service. The Social Insurance Fund still has contributions “for injuries”. Form 4-FSS has become noticeably simpler. 1 47019.04.17

By Order of March 28, 2017 N 114, the FSS approved the specifics of filling out calculations for compulsory social insurance against industrial accidents and occupational diseases by policyholders registered in the territorial bodies of the FSS located on the territory of the constituent entities of the Russian Federation participating in the implementation of the pilot project (form 4-FSS) . The new form 4-FSS was approved by FSS order No. 381 dated September 26, 2016 in connection with the transfer of administration... 65819.04.17

Order of the Federal Insurance Fund of the Russian Federation dated March 28, 2017 N 114 “On approval of the specifics of filling out by policyholders registered with the territorial bodies of the Social Insurance Fund of the Russian Federation located on the territory of the constituent entities of the Russian Federation participating in the implementation of the pilot project, calculations for accrued and paid insurance premiums for compulsory social insurance from accidents at work and occupational diseases, as well as expenses for the payment of insurance coverage (Form 4 - Social Insurance Fund), the form of which is approved by Order of the Social Insurance Fund of the Russian Federation dated September 26, 2016 N 381" 73423.03.17

Order of the Social Insurance Fund dated 03/09/2017 N 83 defined control ratios for calculating contributions for injuries - according to the new truncated form 4-FSS. The same order updated the technology for receiving 4-FSS, which we have already reported. The order will be applied when submitting calculations starting from the first quarter of 2017. Reception and processing of payments for periods expired before January 1, 2017 will occur in the manner established before the changes entered into force. ... 89116.03.17

By order of 03/09/2017 N 83, the FSS amended its order of February 12, 2010 N 19 “On the introduction of secure exchange of documents in electronic form using an electronic digital signature for the purposes of compulsory social insurance.” The new edition sets out the technology for accepting payments from policyholders for accrued and paid insurance premiums in the Social Insurance Fund system in electronic form using an electronic signature. Now counting... 89917.02.17

In 2017, the administration of insurance premiums transferred to the Federal Tax Service. Now employers will calculate insurance premiums according to the new rules and submit reports - both a single Calculation of Insurance Premiums and forms 4-FSS and others, according to new forms and in different terms than in 2016. 9 29109.02.17

A draft specification for filling out compulsory social insurance against industrial accidents and occupational diseases (Form 4-FSS) by insurers registered with the territorial bodies of the Social Insurance Fund located on the territory of the constituent entities of the Russian Federation participating in the implementation of the pilot project has been submitted for public discussion. The new form 4-FSS was approved by order of the FSS dated September 26, 2016 No. 381 in connection with the transfer of administration of contributions... 71003.02.17

A draft order has been published by which the FSS plans to amend the new form 4-FSS, which was approved by order dated September 26, 2016 N 381, dedicated only to calculations of contributions for compulsory social insurance against industrial accidents and occupational diseases and is applied starting with reporting for the 1st quarter 2017. This form will take into account the possibility of indicating and accounting for debt owed by the reorganized policyholder and (or)... 95523.01.17

The company submitted to the FSS electronically calculations in form 4-FSS for the 2nd, 3rd, 4th quarters of 2014 and the 1st quarter of 2015, respectively, on July 10, October 10, 2014, January 14 and April 7, 2015, in which the registration number the policyholder mistakenly indicated the number of another company. Accounts for the same periods with the correct registration number were submitted on May 20, 2015. Based on the results of desk audits, the fund indicated... 49915.12.16

Commentary to the order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551@. 6 49507.12.16

Starting with the reporting compiled for the first quarter of 2017, form 4-FSS is filled out only in relation to the amounts of insurance premiums accrued and paid by policyholders for compulsory social insurance against industrial accidents and occupational diseases, as well as the expenditure of funds for the payment of insurance coverage. 4 29919.10.16

By Order No. 381 of September 26, 2016, the FSS approved the form and procedure for filling out the calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases. This form will be used starting from reporting for the 1st quarter of 2017, that is, from the moment when social security contributions for temporary disability begin to be administered by the Federal Tax Service. The form submitted to the FSS will still be... 9 80819.10.16

Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 N 381 “On approval of the calculation form for accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, as well as for expenses for payment of insurance coverage and the Procedure for filling it out”

4 07910.10.16

All insurers who transfer insurance contributions to the Social Insurance Fund from payments to employees are required to submit Form 4-FSS. By Order of the FSS of the Russian Federation dated July 4, 2016 No. 260, changes were made to the current Form 4-FSS. In this regard, you need to submit a report for 9 months of 2016 using a new form. 5 13907.10.16

By Order No. 386 of September 29, 2016, the FSS introduced changes to the technology for accepting 4-FSS settlements using an electronic signature, approved by Order No. 19 of February 12, 2010. In particular, the description of the format of the calculation file in the 4-FSS form was changed, as well as the description control ratios of logistics control indicators. The changes are apparently related to the July adjustment to Form 4-FSS. ... 98907.10.16

In a letter dated 08/17/2016 N 02-09-11/04-03-17282, the FSS once again spoke about changes in the procedure for administering and paying insurance contributions to extra-budgetary funds, including the FSS. Since January 1, 2017, the tax authorities are the administrator of insurance premiums in case of temporary disability and in connection with maternity in terms of income; administration of the costs of paying these benefits remains with the fund. In this regard, the FSS reports... 1 30606.10.16

Letter of the Federal Social Insurance Fund of the Russian Federation dated August 17, 2016 N 02-09-11/04-03-17282 1 73126.07.16

A draft form 4-FSS has been submitted for public discussion, which will be in effect from 2017 - when the authority to administer contributions for temporary disability will be in the hands of the Federal Tax Service. At the same time, the Social Insurance Fund will continue to administer social insurance contributions against industrial injuries and occupational diseases. The form, which will need to be submitted to the Social Insurance Fund on paper no later than the 20th day of the month following the reporting period, in... 2 04025.07.16

By order of July 4, 2016 N 260, the FSS supplemented appendices N 1 and N 2 to its order of February 26, 2015 N 59, which approved form 4-FSS - calculation of accrued and paid insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity, from accidents at work and occupational diseases, as well as the costs of paying insurance coverage. Section II of the form is supplemented with table 6.1.... 1 06125.07.16

Order of the Social Insurance Fund of the Russian Federation dated 07/04/2016 N 260 "On amendments to Appendices No. 1 and No. 2 to the order of the Social Insurance Fund of the Russian Federation dated February 26, 2015 N 59 "On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage and the procedure for filling it out" 1 09206.04.16

By order of 03/09/2016 N 88, the FSS amended its order of June 23, 2015 N 267, which approved the specifics of filling out form 4-FSS for participants in the pilot project. The amendments will take effect on April 15 of this year. The extension of the pilot project to 2016 has been taken into account. At the same time, the regions that already participated in it in 2015 (including those that joined in mid-2015), the features established by Section II will have to... 1 38005.04.16

Order of the Federal Insurance Fund of the Russian Federation dated 03/09/2016 N 88 “On amendments to the Order of the Social Insurance Fund of the Russian Federation dated June 23, 2015 N 267 “On approval of the specifics of how insurers fill out calculations for accrued and paid insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity and compulsory social insurance against accidents at work and occupational diseases, as well as expenses for the payment of insurance coverage (Form 4 - Social Insurance Fund)" 1 45505.04.16

By order of March 29, 2016 N 123, the FSS updated the technology for accepting payments for accrued and paid insurance premiums (Form 4-FSS) in the FSS system in electronic form using an electronic signature. Thus, the new edition contains the corresponding appendix to the FSS order of February 12, 2010 N 19 “On the introduction of secure exchange of documents in electronic form using an electronic digital signature for the purposes of mandatory social... 1 98022.03.16

Order of the Federal Social Insurance Fund of the Russian Federation dated February 25, 2016 N 54 "On amendments to Appendices No. 1 and No. 2 to the Order of the Social Insurance Fund of the Russian Federation dated February 26, 2015 N 59 "On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage and the procedure for filling it out" 2 91522.03.16

The Ministry of Justice registered FSS Order No. 54 dated February 25, 2016, which amended Appendices No. 1 and No. 2 to Order No. 59 dated February 26, 2015, which approved Form 4-FSS - a form for calculating accrued and paid insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity, from accidents at work and occupational diseases, as well as for the costs of paying insurance coverage. ... 2 33216.03.16

The FSS is preparing further changes to Appendices No. 1 and No. 2 to its order No. 59 dated February 26, 2015, which approved Form 4-FSS - a form for calculating accrued and paid insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity , from industrial accidents and occupational diseases, as well as the costs of paying insurance coverage. The draft order has been submitted to the public... 1 01015.03.16

In a letter dated December 10, 2015 No. 17-3/B-608, the Ministry of Labor spoke about the calculation of the fine for late submission of payments in Form 4-FSS. According to the provisions of Law 212-FZ, failure by the payer to submit a calculation of accrued and paid contributions within the prescribed period entails a fine in the amount of 5% of the amount of contributions accrued for payment for the last three months of the reporting (settlement) period, for each full or partial month of delay, but no more 30% of the specified amount and not less... 68614.03.16

Letter of the Ministry of Labor dated December 10, 2015 No. 17-3/B-608 1 00804.03.16

By Order No. 54 of February 25, 2016, the FSS amended Appendices No. 1 and No. 2 to its Order No. 59 of February 26, 2015, which approved Form 4-FSS - a form for calculating accrued and paid insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity, from accidents at work and occupational diseases, as well as expenses for the payment of insurance coverage. The new order is not yet... 3 96604.03.16

Order of the Federal Social Insurance Fund of the Russian Federation dated February 25, 2016 N 54 "On amendments to Appendices No. 1 and No. 2 to the Order of the Social Insurance Fund of the Russian Federation dated February 26, 2015 N 59 "On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage and the procedure for filling it out" 2 13418.01.16

A draft amendment to FSS Order No. 267 dated June 23, 2015 has been published, which approves the specifics of filling out Form 4-FSS for participants in the pilot project. The extension of the pilot project to 2016 will be taken into account. At the same time, regions that already participated in it in 2015 (including those who joined in mid-2015) will have to apply the features established by Section II starting from the first quarter of 2016, although according to the current... 1 10730.12.15

Federal Law of December 29, 2015 N 394-FZ "On Amendments to Certain Legislative Acts of the Russian Federation" 3 00510.09.15

Companies using the simplified tax system apply a reduced tariff for insurance premiums. Because of this, many branches of the fund accept the 4-FSS report only together with a covering letter in which they are required to decipher the income for the reporting period. Does the fund have the right to refuse to accept a 4-FSS report for 9 months if the company refuses to make a transcript? 2 02418.08.15

By order of July 20, 2015 N 304, the FSS amended Appendix No. 2 to its order of February 26, 2015 N 59, which approved the new form 4-FSS - a form for calculating accrued and paid insurance premiums for compulsory social insurance in case temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance... 1 30228.07.15

By Order No. 267 dated June 23, 2015, which will come into force on August 2, the FSS approved the specifics of filling out Form 4-FSS for participants in the pilot project. A similar order dated May 21, 2012 N 180 is no longer in force. Certain features have been established for regions that have already participated in the pilot project as of July 1, 2015, and for those who have just joined the project from this date (this is the Republic of Tatarstan, Belgorodskaya,... 2 23218.05.15

The single portal reported on the anti-corruption examination of the draft order to amend Appendix No. 2 to the FSS order No. 59 dated February 26, 2015, which approved the new form 4-FSS and the procedure for filling it out. Currently, the procedure establishes that the organization’s seal is placed in the field “I confirm the accuracy and completeness of the information specified in this calculation.” This provision will be excluded both in the case where the reliability... 2 43302.04.15

By Order No. 124 of March 27, 2015, the FSS introduced changes to the Technology for accepting payments from policyholders for accrued and paid insurance premiums in the FSS system in electronic form using an electronic signature. Including, the descriptions of the format of the size and name of the calculation file, the format of the calculation file, the control ratios of logical control indicators to the calculation in Form 4-FSS have been updated. Let us remind you that the new form 4-FSS itself... 2 3 95802.04.15

Order of the Federal Social Insurance Fund of the Russian Federation dated March 27, 2015 N 124 "On amendments to the order of the Social Insurance Fund of the Russian Federation dated February 12, 2010 N 19" 2 41325.03.15

FSS Order No. 59 dated February 26, 2015, by which the fund approved the new Form 4-FSS, was registered with the Ministry of Justice on March 20. The new form will have to be used starting with reporting for the 1st quarter of 2015. The existing table 3.1, filled out by insurers making payments to disabled people, will be replaced with a new table 3.1 for information about temporarily staying foreigners (without indicating the amounts of payments for them). Table 4 "Calculation... 6 84125.03.15

6 96111.03.15

The company submitted a calculation to the Social Insurance Fund in Form 4-FSS on January 15, 2014. Based on the results of the desk audit, the FSS held the company liable in the form of a fine in the amount of 170 thousand rubles, citing erroneous calculation parameters - the logical control had not been passed. The company submitted the corrected calculation the next day - January 16. The courts of three instances (case No. A40-109343/2014) declared the fund’s decision invalid, establishing... 2 88104.03.15

By order of February 26, 2015 N 59, the FSS approved the new form 4-FSS. The order is being registered with the Ministry of Justice, and may undergo changes in the process. It is planned to apply the new form starting with reporting for the 1st quarter of 2015. As we previously reported, the draft form provided for the following changes. The existing table 3.1, filled out by insurers making payments to disabled people, will be replaced with a new table 3.1 for... 3 84104.03.15

Order of the Federal Social Insurance Fund of the Russian Federation dated February 26, 2015 N 59 “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage and the procedure for filling it out" 3 44123.09.14

First of all, when checking FSS Form-4, fund employees check the amounts of taxable payments. After all, the calculation of the final amount of contributions depends on them. And although the legislation on this issue has not changed, we recommend that you double-check in your 9-month reporting which payments you included as taxable. 8 22224.01.14

This review presents new documents (clarifications from the Russian Ministry of Finance, tax authorities, and others), which express the positions of these departments on taxation and accounting issues. Knowledge of the positions of tax authorities, financiers and the opinions of the professional community is necessary for an accountant to make decisions and plan work. The review will help you quickly navigate the issues at hand and make an informed decision, taking into account all possible behavior options and their consequences. 3 75622.01.14

Commentary to the order of the Ministry of Labor of Russia dated September 18, 2013 N 467n “On approval of the Administrative Regulations for the provision by the Social Insurance Fund of the Russian Federation of state services for accepting calculations for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage (Form 4-FSS)." 3 28909.01.14

Fund branches will accept Form 4-FSS according to the new administrative regulations. The grounds for refusal to accept payment have been established, and the waiting time in line has been reduced. 3 40909.01.14