45 account "Goods shipped" is designated for the bookkeeping of goods sold, the proceeds of which are recognized later than the moment of shipment. Such situations are possible during export operations, under commission agreements or when transferring property rights without registration.

Account 45 is active. The cost of goods accounted for on the account is the sum of the actual cost and shipping costs. Accounting on this account is carried out in the context of locations (storage) and objects.

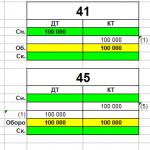

Fragment of the approved Chart of Accounts, Section 4, Finished goods and goods

A commission agreement is an agreement under which one party (commission agent) undertakes to sell the goods of the other party (principal) for a fee. The goods received for sale are the property of the principal.

The subject of the agreement can be both a one-time transaction and several transactions of the same type.

Goods transferred from the consignor to the commission agent are allocated separately in the accounting. To do this, the consignor uses account 45 "Goods shipped".

Example of transactions under a commission agreement

For example, consider the situation when the organization LLC Sigma transfers to the commission of the organization LLC Delta goods for sale worth 300,000 rubles.

Postings for shipment of goods from the consignor's warehouse

Shipment without transfer of ownership

Let's say Sigma LLC sold the fixed asset (building) of Omega LLC at the initial cost of 1,200,000 rubles and the accrued depreciation of 700,000 rubles.

The sales amount was 3,500,000 rubles.

The peculiarity of the implementation of buildings and structures is that they are not physically shipped anywhere or transported. The transfer of ownership is registered in the USRN.

- Prior to the transfer of ownership, Sigma is unable to recognize transaction revenue. At the time of shipment, the fixed asset is debited from account 01 to 45;

- At the moment of transfer of ownership, the residual value of the fixed asset is written off to expense account 91.2.

Shipping transactions before title transfer

Postings after title registration

Features of VAT accounting for operations on account 45

If we are guided by human logic, we cannot charge VAT before we recognize the revenue. But from the point of view of the Tax Code, this is not entirely true. Therefore, it is recommended to make VAT accrual already at the time of transfer of the asset. For calculating the tax base for VAT purposes, the special transition procedure does not matter.

Shipping VAT transactions

The sales invoice is drawn up by the seller:

VAT transactions upon sales

After registration of ownership and recognition of revenue, VAT is charged to expenses.

In what cases is account 45 used (a brief description of the account)

Account 45 - Goods shipped - is used if goods are sold with a deferred transfer of ownership, for example, when exporting products, barter exchange, transferring goods to a commission agent (intermediary, agent) for sale for a commission and under similar agreements. Until the special conditions of the contract are fulfilled, the goods continue to belong to the seller.

Revenue from such transfer of goods cannot be recognized until a number of conditions stipulated in the contract are fulfilled, for example: when selling for export - until confirming documents are received from the buyer, when transferring for sale for a commission - until a commission agent's report and payment for the product sold by him.

Account 45 is an active account. In the accounting of the seller on the debit of account 45 - Goods shipped - the actual (production) cost and commercial expenses for the shipment / delivery of the transferred goods are reflected. The loan is written off the prime cost when conditions are met to reflect the actual sales.

The debit balance on account 45 represents the balances of goods shipped but not sold at the end of the period and is included in line 1210 "Inventories" of the seller's balance sheet.

In the buyer's accounting records, these goods (products) are reflected in off-balance sheet accounts until the date of execution of the contract.

Analytical accounting for the account is carried out for certain types of shipped goods and for their locations (counterparties).

Postings to account 45 (what is reflected in debit, what is in credit)

The use of account 45 in accounting is regulated by the Chart of Accounts and Instructions for its use (order of the Ministry of Finance dated October 31, 2000 No. 94n), as well as PBU 9/99 "Organization's Income" and other regulatory standards.

The most frequently used transactions on account 45:

|

10, 11, 21, 23, 29, 41, 43 |

Inventory items (materials, animals in cultivation, semi-finished products, products of auxiliary and service industries, goods, finished products) were shipped to the buyer at the actual cost price |

|

|

Written off the business expenses for the shipment / delivery of goods shipped |

||

|

VAT charged on the goods transferred (in accordance with the accounting policy) |

||

|

Revenue recognized from actual sales (after fulfillment of special contract terms) |

||

|

Written off the cost of sales based on actual sales |

The option to reflect VAT should be fixed in the accounting policy.

The following options are possible:

- Дт 45 (VAT) Кт 68 - VAT was charged upon shipment of goods;

- Dt 90 Kt 45 (VAT) - VAT is reflected upon actual sale;

- Dt 76 Kt 68 - VAT included on shipment / prepayment;

- Dt 90 Kt 76 - VAT is reflected upon actual sale / receipt of payment;

- Dt 68 Kt 76 - VAT was charged upon actual sale / receipt of payment.

An example of reflecting the implementation on account 45

Conditions of the problem

Company A sold goods in the amount of 35,400 rubles, including 18% VAT, subject to the transfer of rights to this product to the buyer after full payment. The cost of goods was 20,000 rubles.

In the accounting policy of company A, the method of accrual and determination of the taxable base for VAT after the shipment of goods and materials is established.

Solution

Postings in the accounting of company A in accounting on account 45 for this operation:

|

Amount, rub. |

|||

|

After the goods have been shipped: |

|||

|

The cost of goods shipped has been written off |

|||

|

VAT charged on shipment (35 400/118 × 18) |

|||

|

After payment for the goods: |

|||

|

Buyer's payment taken into account |

|||

|

Revenue recognized from actual sales |

|||

|

Reflected VAT charged to the buyer |

|||

|

The cost of this sale has been written off |

|||

|

The financial result was calculated based on the results of the sale (35,400 - 5,400 - 20,000) |

|||

***

Account 45 is called "Goods shipped". It is applied when selling goods with special conditions on the transfer of rights to the goods to the buyer in the sales contract. Therefore, revenue can only be recognized when these conditions are met.

Don't know your rights?

Count. 45 "Goods shipped" is used to record operations for the shipment of the company's goods, when the proceeds from sales cannot be accepted for accounting in the accounting department at the time of transfer of the product.

Account 45 in accounting is a collection account that displays information about products shipped to customers, the sales income for which cannot be temporarily accepted in the company's accounting. This situation is possible in a number of cases:

- Additional terms of the agreement, without which the transfer of ownership is impossible (for example, full payment for delivery is provided);

- Barter transactions for which the counter receipt of products has not been made

- In addition, information about goods and products of own production transferred for sale to intermediaries-commissioners is recorded here.

By account 45, the following main sub-accounts are provided:

45.01 - accounting of products purchased from suppliers for resale is carried out

45.02 - information about products of our own production

45.03 - other nomenclature units

45.04 - generalization of information about the transfer of the transferred real estate objects, the change of ownership of which has not yet been registered.

Information on the availability and transactions with shipped products is displayed on account 45 at the total cost of actually incurred costs for the production or purchase of goods and cash expenses for shipment (with partial write-off of transport costs).

Account 45 is active in accounting. The debit records the transfer of products to the buyer or agent in correspondence with the corresponding accounts 41, 43 on the basis of closing documents (TORG-12, transfer certificates, etc.).

Attention! For buyers or intermediary organizations, the transferred products must be recorded on off-balance sheet accounts until all conditions of the agreements are fulfilled.

The amounts accumulated on the account are written off to Dt90 “Sales” at the time of recognition of income from sales or when the intermediary firm reports the sale.

Analytical monitoring

Analysis of the availability and movement of products shipped to buyers or commission agents is carried out by counterparties (locations of products) and nomenclature items of goods.

Legislative regulation

Using the count. 45 to summarize information about the transferred products, the income from the sale of which has not yet been taken into account, is carried out in accordance with the current Chart of Accounts approved by order of the Ministry of Finance dated October 31, 2000 No. 94, PBU 9/99 "Income of the organization" and other regulatory documents.

Basic business transactions, postings on them

- Transfer of products to buyers or intermediaries for subsequent resale

Dt45 Kt41 - goods purchased for resale

Dt45 Kt43 - products of our own production

Dt45 Kt21 - semi-finished products of our own production

- Write-off of the cost of products after all conditions are met

Dt90.02 Kt41 (43)

- Inclusion of selling expenses in the cost of goods shipped

When selling goods, and finished products, the moment of transfer of ownership may not be shipment, but the moment of payment. That is, when the buyer pays for the goods, then from account 45 we write off the goods or products at the cost of sales to account 90 (before that, the goods transferred to the buyer will be listed on account 45). This account can also be used in other cases when exporting, and when selling goods through an intermediary.

Characteristics of account 45 "Goods shipped"

Account 45 - This account is called "Goods Shipped". The debit of this account takes into account the cost of goods shipped, finished products at their actual cost. (Before the ownership was transferred to the buyer, for example, before payment), sales costs may also be taken into account. On the loan, write-off of the actual cost (dt 90 Kt 45). Debit active account balance at the beginning and balance at the end. The formula for calculating the balance at the end of the account 45 = Debit balance + Debit turnover -Credit turnover. On the balance sheet, account 45 is reflected under the item "RESERVES" in the balance sheet asset. 76 / VAT is reflected in the balance sheet under the line other current assets.

A contract in which title does not transfer during shipment is called a contract with a special order of transfer of title (this may be the moment of payment).

In what operations is used:

- Upon implementation, when the ownership of the goods passes after payment (example below)

- When selling goods through an intermediary.

- For barter transactions. (Example below)

- Upon transfer of ownership of goods, products upon receipt from a transport organization.

Accounting with the seller (upon payment, transfer of ownership)

Account 45 transactions:

- Debit 45 Credit 43 or 41-Finished products or goods were shipped to the buyer.

- Debit 45 / VAT or 76 / VAT credit 68 / VAT - VAT is charged on the shipped products. (VAT is charged because the buyer needs to charge VAT on the shipment). (In 1c for accounting for VAT on shipped goods, account 76 / OT is provided) (76 / VAT reflected in the balance sheet on the line other current assets.)

- Debit 51 Credit 62-Payment has been received from the buyer.

- Debit 62 Credit 90-1-Accrued proceeds from sales.

- Debit 90-2 Credit 45-Written off the cost of finished goods or goods.

- Debit 90-3 Credit 76 / VAT or 45 / VAT- VAT is reflected.

Example:

01,01,2019-The goods were shipped to the buyer in the amount of 100,000 rubles at the cost price. At a sale price of 150,000 rubles. incl VAT

01/15/2019-The buyer paid the invoice.

Transfer of ownership of the goods after payment.

Solution:

01,01,2019:

1) Debit 45 Credit 41-100,000 rubles - The cost of the goods shipped has been written off.

2) Debit 76 / VAT Credit 68 / VAT-25,000 rubles (150,000 / 120 * 20) -VAT is charged on the goods shipped.

15,01,2019:

3) Debit 51 Credit 62-150000 rubles - Payment has been received from the buyer, including VAT.

4) Debit 62 Credit 90-1-150000 -Proceeds from the sale are reflected.

5) Debit 90-2 Credit 45-100,000 rubles - The cost of goods sold has been written off.

6) Debit 90 / VAT credit 76 / VAT-25000 Reflected VAT.

Accounting with the buyer upon transfer of ownership of the payment.

Postings:

Debit 002 Credit NO-Accepted goods title to the goods is not transferred to the buyer

Debit 60 Credit 51-Payment to the supplier.

After payment:

Credit 002-The goods were written off from the off-balance account after payment

Debit 41 Credit 60/01-Title to the goods passed to the buyer.

Example: The cost of purchased goods is 120,000 rubles (including VAT). Transfer of ownership after payment.

- Debit 002 (inventories accepted for safekeeping) -120,000 rubles - The goods arrived, the ownership of the goods did not pass to the buyer

- Debit 60 Credit 51 - 120,000 rubles - Payment to the supplier

- Credit 002 - 120,000 rubles - Products debited from account 002

- Debit 41 Credit 60-100000 rubles (120,000 / 120 * 100) -The ownership of the goods passed to the buyer

- Debit 19 Credit 60-20000 rubles (120,000 / 120 * 20) -VAT from the purchase.

Barter using account 45

Usually in barter transactions (barter is the mutual exchange of goods and services without the use of monetary settlements). Before you receive the goods (MPZ) in exchange for your products transferred to the supplier, the products will be listed on account 45.

Postings:

- Debit 45 Credit 41 (43) -Transferred the goods by barter (in return, the goods were not received).

- Debit 76 / VAT Credit 68 / VAT - Reflected VAT on shipment

- Debit 41 (or 10) Credit 60-Received goods

- Debit 19 Credit 60-VAT on purchase.

- Debit 62 Credit 90-Reflected revenue

- Debit 90 Credit 45-Written off the cost of the goods transferred.

- Debit 90 Credit 76 / VAT - VAT from the sale

- Debit 60 Credit 62-Offset made.

Example:

Condition:

The cost of the goods received is 120,000 rubles (including VAT 20%), the cost of the goods transferred is 50,000 rubles. Barter

Solution:

On the date of shipment:

- debit 45 Credit 41-50,000 rubles.

- Debit 76 / VAT credit 68 / VAT-20,000 rubles (120,000 / 120 * 20).Date of receipt of goods:

- Debit 62 Credit 90-1-120000 rubles - The sale of goods is reflected.

- Debit 90-2 Credit 45-50000 rubles - The cost of goods has been written off.

- Debit 90 / VAT credit 76 / VAT-20,000 rubles-VAT

- Debit 41 Credit 60-100,000 rubles (120,000 * 120 * 100)

- Debit 19 Credit 60-20000 rubles (120,000 / 120 * 20) -VAT on received goods.

- Debit 60 Credit 62-120000 rubles OFFSET of mutual claims.

WIRING:

- Debit 45 Credit 10-Materials shipped to buyers. (With the special condition of transfer of ownership)

- Debit 45 Credit 20- The cost of work for which the proceeds from the sale for which temporarily cannot be determined has been written off.

- Debit 45 Credit 21- Semi-finished products are shipped, on payment the moment of transfer of ownership.

- Debit 45 Credit 41-Goods shipped to the buyer, the moment of transfer of ownership after payment.

- Debit 45 Credit 43- The product is shipped to the buyer, the moment of transfer of ownership after payment.

- Debit 45 Credit 44-Written off costs associated with the sale of goods and finished products.

- Debit 45 Credit 71-Reflected expenses related to the sale of products. (Document advance report)

- Debit 90-2 Credit 45-Written off the cost of shipped products or goods after the transfer of ownership.

- Debit 94 Credit 45-The shortage of goods by the products shipped is reflected.

- Debit 99 Credit 45-Written off the cost of finished goods after an emergency.

- Debit 76 Credit 45-Written off at the expense of the insurance organization, goods shipped

For certain reasons, it happens that the company is unable to receive funds for the shipped products for a certain period of time. Just in these cases, it is necessary to reflect such operations at 45 positions. Today's topic is devoted to questions about what a finished product is, what should be understood as shipped goods and how they are sold, what is the purpose of 45 accounts in accounting, what accounting records are kept, and we will also analyze one of the practical examples.

Definition of finished goods and goods

Upon completion of the production process, the company receives a finished product from the raw materials used. This product is fully stocked, handed over to the warehouse and is already ready for sale.

Finished products should be perceived as part of inventories that will subsequently be sold and meet the required technical parameters and quality standards.

As part of production stocks, you can also perceive goods that were received or purchased from business entities or citizens for subsequent sale.

If we consider the flow diagram of the finished product, then it consists of the following stages:

- receipt of a batch of a product at the warehouse;

- shipment of the finished batch to consumers.

When conducting accounting, the unit of the finished product is determined by the company in such a way that the company's management can obtain adequate information about the state of these inventories, as well as ensure adequate control over their movement and residues. Finished products enter the warehouse from the production workshop under the responsibility of the material person.

The goods shipped are ...

This definition should be understood as those inventories, the proceeds from the sale of which cannot be formalized by the corresponding accounting records.

If we talk about form No. 1 of financial statements, then the price of finished products shipped to buyers is recorded on line 080 of the balance sheet. In this line, the accountant enters a debit balance on account 45 at the end of each reporting period.

In general, property rights to certain inventories are transferred to the customer after their delivery in the last turn. However, there are some exceptions to this general rule:

- in the case of the transfer of goods in accordance with an exchange agreement (in this case, the buyer acquires the property right only after the counter-shipment has been made;

- if the goods are transferred under a sale and purchase agreement, which provides for a special procedure for the transfer of ownership. According to such documents, the person who purchases the goods receives the title to it only after certain conditions are met, for example, payment of its cost or delivery to the designated point;

- in case of transfer to an intermediary for further sale. In this case, we are talking about a commission agreement, order or agency agreement.

Sale of shipped goods

The reflection of transactions for the sale of the shipped batch will depend on the conditions reflected in the contract, including such points as:

- how the goods are transferred to the buyer, i.e. whether there is an intermediary or the work is carried out directly;

- at what stage the ownership of the goods passes to the buyer, for example, at the time of shipment or after the transfer of funds in payment for the goods received.

Suppose that the contract with the customer includes special conditions for the transfer of ownership and disposal of the purchased items. The terms of such an agreement should also provide for the risk of accidental damage to the goods received after receipt of payment for them.

Necessity and significance of 45 position

45 account is necessary in order to summarize data on the available shipped products and their movement, the proceeds from the sale of which at this stage cannot be recognized. According to this position, companies also keep records of finished products transferred to the commission for subsequent sale.

The specified account is active. The accounting department reflects the cost of the shipped batch based on its actual cost and the cost of shipping goods.

Account 45 is debited in correspondence with 41 and 43 positions.

Typical accounting entries

Typical postings on account 45 are made out with the following accounting entries:

CT 10 - transfer of materials to a third party;

CT 21 - shipment of semi-finished products of its own production to third parties;

CT 43 - shipment of finished products;

CT 45 - accounting for the shortage of inventories that were recorded as shipped.

An example of accounting for operations on 45 positions

Suppose that a certain company sells goods, the total value of which is 48,300.0 rubles, including VAT in the amount of 8694.0 rubles. In accordance with the terms of the agreement, the buyer will receive property rights to the goods only after its full price has been paid. In this case, the cost of production is 31,000.0 rubles. The accounting policy of the company says that the accrual method is applied when maintaining accounting records.

Based on the results of the transaction, the accounting department reflected the following entries:

Kt 41 - 31,000.0 rubles, accounting for the cost of production;

Kt 68 - 8 694.0 rubles, VAT accrual;

Kt 62 - 48,300.0 rubles, receipt of funds from the buyer;

Kt 90.1 - 48,300.0 rubles, accounting for proceeds from sales;

Kt 45 - presentation of VAT to the buyer;

Kt 45 - 31,000.0 rubles, reflection of s / s products;

Kt 99 - RUB 8,606.0, accounting for the financial result following the transaction.

Conclusion

In conclusion, it should be added that the need to account for shipped products with special conditions for the transfer of ownership is due to the instruments that companies currently operate in the framework of financial and economic activities. And the task of accounting in this case is to correctly reflect these transactions.